Step onto the dance floor with the Spear Alpha ETF (NASDAQ:SPRX), a diminutive presence with mere $72.3 million in assets under management. Yet, do not underestimate its power. This shadow dweller managed to dazzle spectators last year with a waltz of stellar returns, nearly reaching an incredible 90%. In the big, bustling ballroom of the stock market, this underdog knows how to move and groove its way into the spotlight, beckoning for a closer look.

Cracking the Code: What Drives the SPRX ETF?

The Spear Alpha ETF, a creation of Spear Funds, prides itself on being an active participant in the stock market minuet. It seeks out companies riding the wave of breakthroughs in industrial technology, aiming its spotlight on opportunities hidden in the shadows. SPRX sets its sights on tech trends like artificial intelligence, automation, and robotics, as well as other forward-thinking themes such as environmental sustainability, digital transformation, and the uncharted frontier of space exploration.

Based on its unique themes, SPRX sets sail in search of long-term treasures, navigating the seas of capital growth with the wind of innovation at its back.

A Symphony of Stocks: The Intriguing Holdings of SPRX

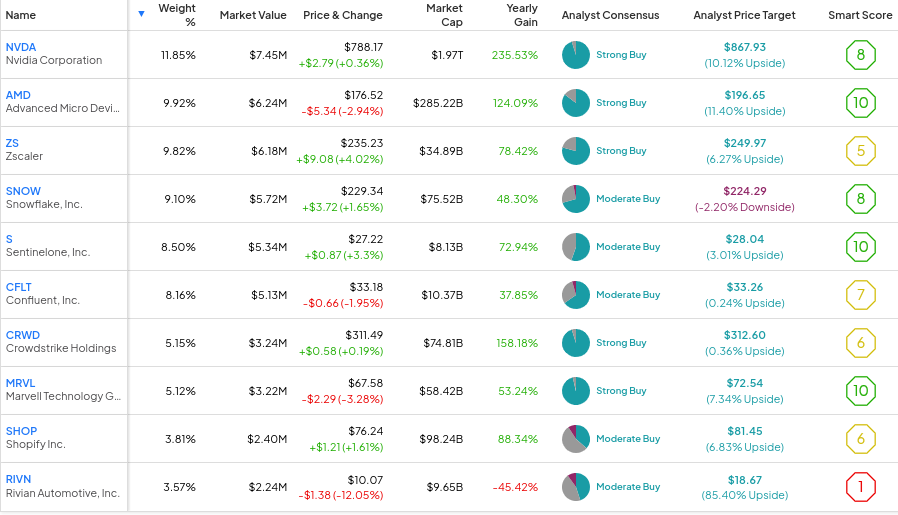

Amidst the 27 instruments in its orchestra, SPRX spotlights its virtuosos – a harmonious top 10 that commands 75% of the stage. This ETF is no polymath, for its purpose is not diversity but focus. The melody of its success hinges on the performance of these star players. Should the leading cast enthrall, SPRX will sway to celestial heights, but a discordant note could lead to a fall from grace.

Peek behind the curtain, and you’ll witness SPRX’s prominent picks conducting a symphony of generative AI with maestros like Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD). These powerhouses led the charge, with Nvidia soaring 235.5% and AMD ascending 124.1% over the past year. The fund also holds a significant position in Marvell Technology (NASDAQ:MRVL), orchestrating a 53.2% crescendo in the same period.

Beyond the realm of AI, cybersecurity prodigies like Crowdstrike (NASDAQ:CRWD), Zscaler (NASDAQ:ZS), and SentinelOne (NYSE:S) take center stage in SPRX’s ensemble.

Delving deeper, you’ll find SPRX’s repertoire infused with cadences of software excellence from Snowflake (NYSE:SNOW), Confluent (NASDAQ:CFLT), and Hubspot (NYSE:HUBS). The resonance of electric vehicles reverberates through the fund’s investments in industry giants like Tesla (NASDAQ:TSLA) and rising stars like Rivian (NASDAQ:RIVN).

While SPRX’s tune resonates with tech, its melody ventures beyond the beaten path. Nestled among its notes, you’ll find strains of basic materials and mining firms like Freeport McMoran (NYSE:FCX), Rio Tinto (NYSE:RIO), and Albemarle (NYSE:ALB). As the world embraces a future of electrification and decarbonization, SPRX’s astute managers recognize the impending crescendo in demand for resources like copper from Freeport McMoran and lithium from Albemarle.

These unconventional investments, unlike the flashy EV newcomers, boast profitability, attractive valuations, and even dividends, resonating a melody of financial prudence.

Altogether, SPRX orchestrates a symphony of growth themes, showcasing an eclectic investment approach that harmonizes with the market’s beat and rhythm.

A Star is Born: The Dazzling Performance of SPRX

In the ever-spinning carousel of the market, SPRX emerged on stage in 2021, waltzing into the limelight. The year 2022 tested its mettle, with a challenging decline of 45.0% as tech stocks faced the music. Yet, the tale took a delightful turn in 2023, with a show-stopping performance of an 88.0% gain.

While the entire tech and growth sector found its groove, SPRX’s spectacular 88% leap outshone the popular tech-themed index ETFs. For instance, the Invesco QQQ Trust (NASDAQ:QQQ) and the Technology Select Sector SPDR Fund (NYSEARCA:XLK) each posted gains of 54.9% and 56.0%, respectively. Impressive as these returns are, SPRX stole the show.

Even the star-studded ARK Innovation ETF (NYSEARCA:ARKK) fell short, with a commendable 67.6% return. This underdog has shown its potential, taking strides that resonate with investors.

While expecting SPRX to maintain such soaring heights is a tall order, its past performance speaks volumes and hints at a promising future.

Exploring the Cost: What Lies Behind SPRX’s Expense Ratio?

Bearing a 0.75% expense ratio, SPRX reveals a potential Achilles’ heel. This cost may seem weighty, demanding investors to pay a toll of $75 on a $10,000 investment annually.

However, as a small, actively managed performer, this fee isn’t an outlier. In the realm of actively managed tech ETFs, peers like the ARK Innovation ETF also carry the same 0.75% burden. For now, its commendable performance might soften the blow of such a price tag, yet a change in the melody could amplify such costs, leaving a bitter aftertaste for investors.

Is SPRX a Star in the Making? Analyst Insights

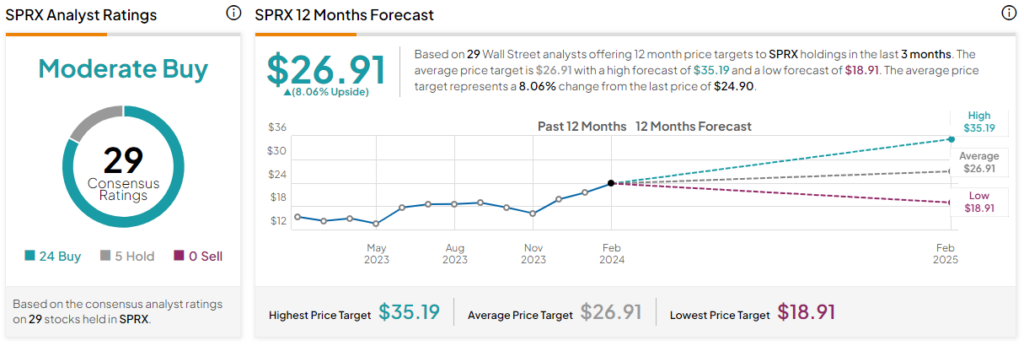

Turning to the Wall Street chorus, SPRX belts out a Strong Buy tune, harmonizing to the tune of 24 Buy ratings and five Holds in the last three months. With an average price target of $26.91, a crescendo of 8.1% upside potential dances in the horizon.

Embracing the Future

SPRX, a hidden gem in the tumultuous world of ETFs, made a grand entrance with its resplendent 90% return last year, outshining its peers. The limelight may dim, but the echoes of its triumph resonate as it paves its path in 2024.

While not a seamless act, SPRX’s impressive repertoire and diverse portfolio resonate with a spectrum of growth themes. From AI to the gears of vehicle electrification, this ETF boogies to a unique beat in the tech realm, shying away from cookie-cutter strategies of investing in traditional tech giants.

Remember, behind the curtain lies a cost – a 0.75% expense ratio that may prove a hurdle. If SPRX continues to outshine its competitors, this challenge may fade into the background. However, a dimmer performance could cast a shadow on this otherwise shining star.

Embracing its youth, high costs, and focused portfolio, SPRX beckons to bold investors willing to ride the wave of risk and reap the rewards of its memorable performance.

Disclaimer: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.