A Close Look at the Recent Stock Market Sell-Off

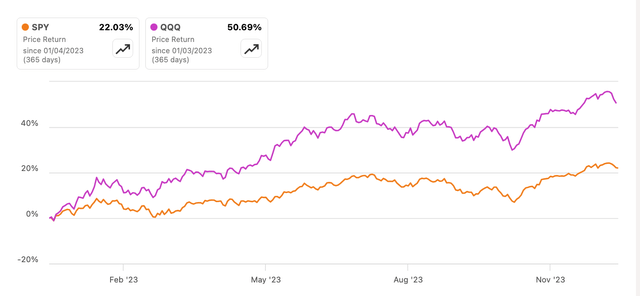

After the recent stock market sell-off in early January, many investors have grown anxious about the prospects of the bull market in 2024. In light of that, back in October 2023, we had the foresight to issue strong buy ratings on SPY (NYSEARCA:SPY) and QQQ (NYSEARCA:QQQ) despite concerns about a government shutdown, widening deficits, and soaring stock valuations.

Our confidence at that time stemmed from two primary reasons that supported our optimism about the market’s upward potential. First, the predominant driver of the U.S. economy – consumer spending – and the private sector were exhibiting a greater influence on growth, hinting at a well-functioning economy. Second, our assessment of fundamental and forward-looking metrics validated the justifiability of stock valuations for both ETFs. As a result, our recommendations proved to be well-founded as both ETFs performed remarkably well.

We make it a point to periodically assess the major index ETFs each quarter, offering investors our insights as a point of reference. As we revisit the framework used last time and update our outlook for 2024, it’s evident that the recent sell-off is driven by a trio of decisive factors.

The Underlying Causes of the Recent Sell-Off

It’s apparent that the recent sell-off has been propelled by a combination of three key factors:

The Impact of Short-Term Overbought Conditions

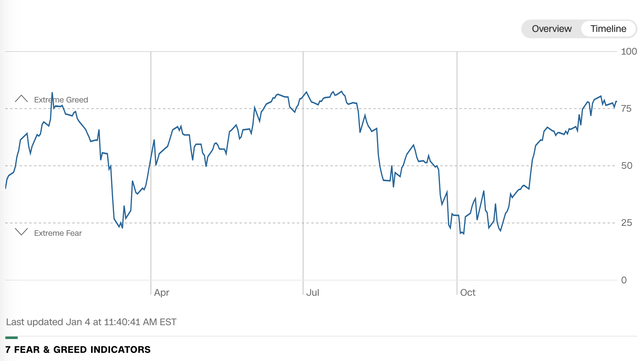

Firstly, the market had become overbought in the short term, as indicated by CNN’s Fear & Greed Index pointing to stocks being in an extreme greed territory, thereby making a correction seem inevitable.

The Uncertainty Surrounding Fed Rate

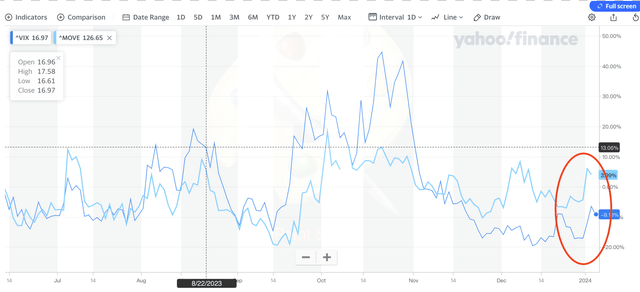

Secondly, uncertainty looms over whether the Fed will lower rates in 2024, with certain Fed members expressing dissent towards Chairman Powell’s comments about discussing rate cuts at the December meeting. This has led to ETFs like TLT retracting and increased volatility in the bond market, as measured by the MOVE index. The volatility in the stock market, on the other hand, seems to largely reflect the uncertainty around bond yields and potential rate cuts, akin to what was witnessed in October.

However, it is notable that while bond market volatility has intensified, stock market volatility hasn’t surged to the same extent, suggesting that the stock pullback predominantly mirrors the uncertainty surrounding bond yields and potential rate cuts.

The Effect of the Year-End Rally

Thirdly, the customary year-end rally that is usually fueled by holiday spending and tax-loss harvesting has led investors to sell off losing positions and retain winning ones. Given that SPY and QQQ witnessed substantial growth in 2023, it’s unsurprising that they encountered selling pressure on the first trading day of 2024 as investors trimmed positions to avoid capital gains tax.

Evaluating the Fundamentals of QQQ and SPY

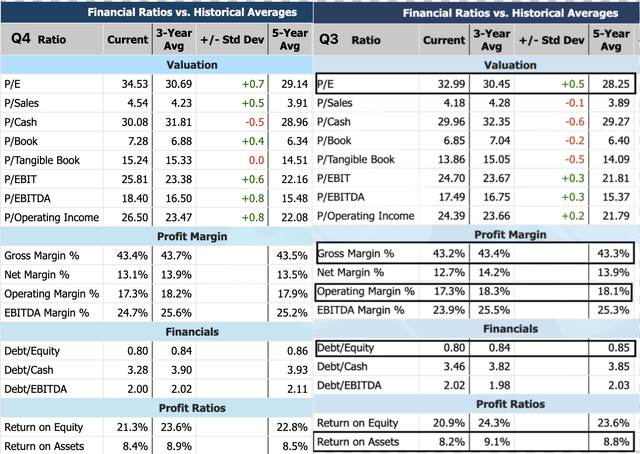

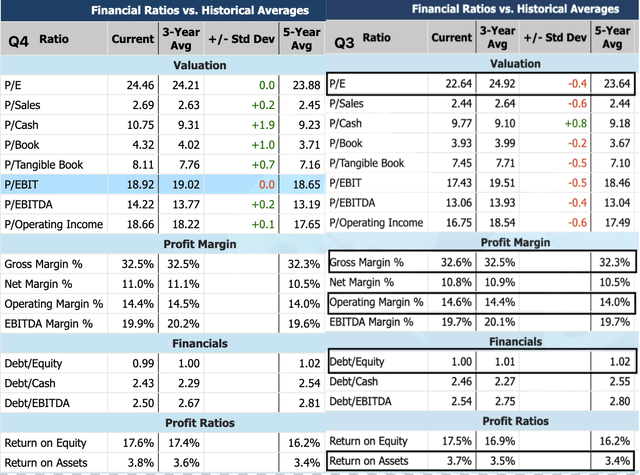

When dissecting the Q4 and Q3 fundamentals for QQQ and SPY, the recent sell-off appears to have been prompted by the aforementioned three factors. Let’s delve into each ETF:

For QQQ, the P/E ratio increased from 32.9x to 34.5x, indicative of enhanced financials. Gross margins surged from 43.2% to 43.4%, while ROE climbed from 20.9% to 21.3%. Our previous observation that 11% ROE is a crucial threshold for gauging whether stocks offer a lucrative return premium over bonds still holds true. With QQQ companies continuing to generate an exceptional 21.3% ROE, we remain steadfastly committed to stocks.

While these ratios are retrospective, they validate the P/E expansion supported by fundamental improvements. This aligns with the dominance of mega-cap tech firms propelling QQQ’s earnings growth through AI adoption.

On the other hand, with SPY, we witnessed P/E multiples expand from Q3 to Q4, although there was a slight deterioration in fundamentals – gross margins dipped by 10 basis points, and operating margins by 20 basis points. Nevertheless, with ROE ticking up to 17.6%, comfortably surpassing our 11% threshold, we remain positive about maintaining an allocation to stocks.

The Long-Term Wealth Creation Potential of SPY and QQQ ETFs

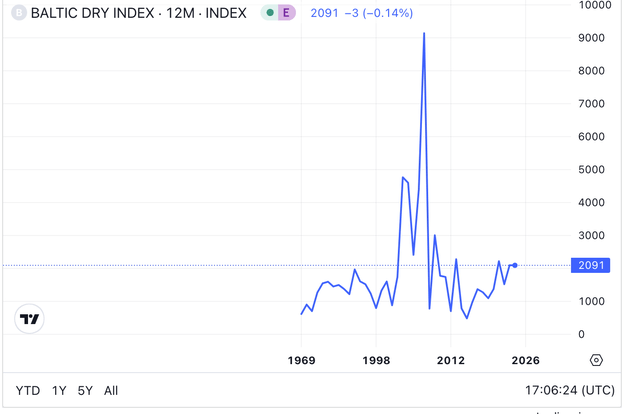

The recent tumultuous events around the Red Sea have once again rattled the global shipping markets, causing international shipping costs to surge and the Baltic Dry Index to spike dramatically. Some observers fear this could reignite inflationary pressures, but the truth is less dire. Yes, the situation is concerning, but geopolitical dynamics and the changing energy landscape mean that these disruptions are unlikely to have a significant long-term impact on the US economy. Despite the short-term volatility, the fundamentals underpinning the SPY and QQQ ETFs still provide an attractive investment opportunity for long-term investors.

Navigating the Red Sea Crisis

Impact on Global Shipping Costs

The recent escalation in the Red Sea has led to a spike in international shipping costs, as evidenced by the soaring Baltic Dry Index.

While the geopolitical tensions in the Middle East, particularly involving the Houthi rebels and potential Iranian involvement, are causes for concern, the shift in the global energy landscape, with the United States emerging as a leading oil producer, mitigates the potential impact on the US economy. Furthermore, efforts to resolve such regional conflicts indicate a desire for stability, adding to the belief that these disruptions are manageable from a long-term investment perspective.

Assessing Long-Term Systemic Risks

For investors considering broad market ETFs like SPY or QQQ, the focus on long-term capital appreciation takes precedence over short-term valuation concerns. Despite fluctuations in valuations, the US economy’s competitive strength and stability suggest that systemic risks that could fundamentally alter the long-term investment thesis for these ETFs are currently not a significant concern.

Conclusion: A Long-Term Investment Opportunity

In summary, the recent sell-off does not alter our positive outlook on owning a basket of leading US stocks represented by SPY and QQQ. While short-term volatility is to be expected, the long-term wealth creation potential of these ETFs remains compelling, offering investors a chance to position themselves for long-term capital growth. Rather than being swayed by short-term market sentiment, investors should focus on the fundamental strength underlying these assets and use the current dips as an opportunity to build positions for the long term.

The landscape for global shipping may be stormy, but amid this turmoil, the SPY and QQQ ETFs stand as beacons of stability and growth for astute long-term investors.