Analysts Predict Significant Upside for ProShares Ultra S&P500 ETF

At ETF Channel, we analyzed the underlying holdings of various ETFs in our coverage. We compared the trading prices of each holding against the average analyst 12-month forward target prices, allowing us to calculate the weighted average implied analyst target price for the ETF itself. For the ProShares Ultra S&P500 ETF (Symbol: SSO), the implied target price based on its underlying holdings stands at $89.45 per unit.

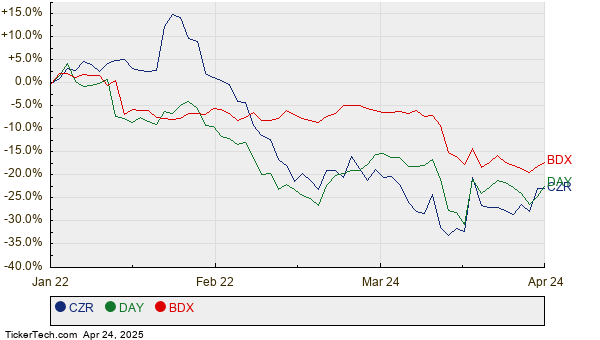

Currently, SSO is trading around $74.14 per unit, suggesting a potential upside of 20.66% based on the average target prices of its underlying holdings. Notable among these holdings are Caesars Entertainment Inc (CZR), Dayforce Inc (DAY), and Becton, Dickinson & Co (BDX), each showing promising upside potential.

Caesars Entertainment has a recent trading price of $26.72 per share, with analysts forecasting a target of $42.43 per share, indicating an upside of 58.79%. In a similar vein, Dayforce is currently priced at $55.57, yet analysts predict a rise to $75.75, reflecting a potential increase of 36.31%. Meanwhile, Becton, Dickinson & Co has a recent price of $202.32, with an anticipated target of $270.80, suggesting an upside of 33.85%.

Below is a twelve-month price history chart comparing the stock performances of CZR, DAY, and BDX:

Summary of Current Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ProShares Ultra S&P500 ETF | SSO | $74.14 | $89.45 | 20.66% |

| Caesars Entertainment Inc | CZR | $26.72 | $42.43 | 58.79% |

| Dayforce Inc | DAY | $55.57 | $75.75 | 36.31% |

| Becton, Dickinson & Co | BDX | $202.32 | $270.80 | 33.85% |

Investors may question whether analysts are justified in their target prices or if they are being overly optimistic about these stocks’ performance in the next 12 months. A high target price compared to a stock’s trading price often signals optimism, yet it can also forewarn possible downgrades if those targets no longer align with current market realities. Therefore, these aspects warrant thorough investor investigation.

10 ETFs With Most Upside To Analyst Targets »

Additional Reading:

• Affordable Consumer Stocks

• Expected Average Annual Returns

• SCHZ Year-To-Date Returns

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.