**Key Points on AI Market Trends and Investor Moves**

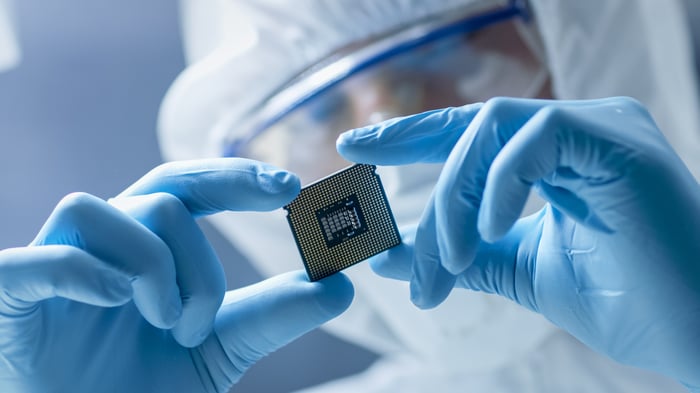

According to PwC analysts, the global market for artificial intelligence (AI) is projected to reach $15.7 trillion by 2030. Billionaire investor Stanley Druckenmiller, managing nearly $4.1 billion at Duquesne Family Office, has recently exited his entire position in Nvidia, a leader in AI hardware, raising questions about his investment strategy amid rising AI competition. He has actively invested in Taiwan Semiconductor Manufacturing (TSMC), acquiring shares in four of the last five reported quarters, reflecting his confidence in TSMC’s growth potential in AI chip manufacturing and beyond.

In the June 2024 quarter, Druckenmiller’s Duquesne sold off its Nvidia shares, despite Nvidia holding over 90% market share with its advanced GPUs. Meanwhile, TSMC’s stock has entered a $1 trillion market cap, driven by substantial demand for AI GPUs. The company’s diverse production capabilities, supplying not only AI chips but also processors for other tech sectors, offer a broader resilience against potential market fluctuations related to AI technology.