Star Group Reports Mixed Earnings for Q1 Fiscal 2025 Amid Stock Decline

Star Group, L.P. Common Units’s SGU shares have declined 1.5% since the company released its earnings report for the first quarter of fiscal 2025. In comparison, the S&P 500 index saw a smaller drop of 0.6% during the same period. Interestingly, SGU shares rose 10.7% over the past month, while the S&P 500 increased by 3.3%.

First Quarter Earnings Overview

Star Group recorded earnings per share of 79 cents in the first quarter of fiscal 2025, a remarkable increase of 147% from 32 cents during the same quarter last year.

For the fiscal first quarter ending December 31, 2024, SGU experienced a 7.6% drop in total revenues, which totaled $488.1 million, down from $528.1 million in the previous year. This revenue decline was largely due to lower average petroleum prices, despite a slight uptick in product volumes and service and installation revenues.

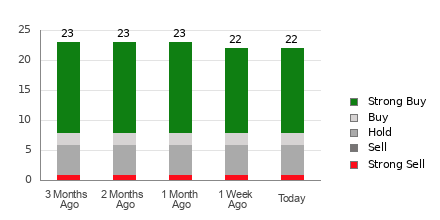

Market Performance and EPS Analysis

Star Group, L.P. price-consensus-eps-surprise-chart | Star Group, L.P. Quote

Operational Highlights

In the first quarter, the company sold 82.4 million gallons of home heating oil and propane, marking a 2.8% increase compared to the same quarter last year. This rise can be attributed to acquisitions and temperatures that were 4.1% colder than the previous year, although still 10.5% warmer than the historical average. Gross profit from service and installation efforts rose to $6.9 million, up from $4.4 million, reflecting both acquisition synergies and improved performance in core operations.

Adjusted EBITDA for the quarter climbed 5.8% year over year to $51.9 million, as enhanced margins and contributions from new acquisitions counteracted volume declines in the core business.

Cost Analysis

Total expenses in the first quarter aligned with revenue reductions, in part due to lower petroleum prices. The cost of products sold was reduced to $248.7 million from $303.3 million, reflecting an 18.4% drop in wholesale petroleum prices.

Delivery and branch costs increased by 5.3% year over year to $99.3 million, primarily due to acquisition activities. General and administrative expenses saw a slight rise to $7.2 million, while depreciation and amortization expenses fell to $7.9 million from $8.4 million in the prior year. A notable $5-million non-cash credit related to derivatives contrasted with a $19-million non-cash charge in the previous year.

Liquidity and Debt Overview

As of December 31, 2024, Star Group’s cash and cash equivalents were reported at $48.8 million, down from $117.3 million at the end of fiscal 2024. This drop was mainly due to cash expenditures for acquisitions and increased working capital needs.

The company’s total debt stood at $211.5 million, comprising $182.7 million in long-term debt and $7.8 million in revolving credit facility borrowings. Although debt levels rose compared to the previous quarter, management emphasized a commitment to maintaining financial flexibility and sufficient cash flow to support ongoing operations and growth initiatives.

Management Insights

President and CEO Jeff Woosnam emphasized positive results from service and installation operations as well as successful execution of strategic acquisitions. He expressed optimism for the remainder of fiscal 2025, noting that colder temperatures in January and a commitment to operational efficiency and customer service will bolster the company’s outlook.

CFO Rich Ambury highlighted the improved per-gallon margins and EBITDA contributions from recent acquisitions as significant factors in the company’s financial performance, though he acknowledged challenges from customer attrition and heating season demand fluctuations.

Underlying Factors Affecting Performance

Several key factors influenced the company’s results, including colder weather, improved per-gallon margins, and strategic acquisitions. Although lower wholesale petroleum prices led to decreased selling prices affecting total revenues, they also made heating services more affordable for customers. The management team credited internal initiatives that focused on enhanced productivity and cross-selling of products and services for bolstered results during a challenging period.

Future Outlook and Strategy

SGU anticipates continued growth potential, particularly due to unexpectedly cold temperatures early in the fiscal second quarter and operational improvements. While specific guidance was not provided, the strategic focus remains on pursuing acquisitions to counteract customer attrition, maintaining high-quality service, and effectively managing costs.

Recent Developments

After the conclusion of the first quarter, Star Group secured a substantial acquisition that enhanced its propane distribution capabilities within its areas of operation. Management believes this acquisition will drive future growth and effectively complement existing operations, and they expressed enthusiasm for integrating the new business to realize synergies.

In summary, Star Group’s first-quarter performance demonstrated robust bottom-line improvements despite challenges related to revenue from lower petroleum prices. Strategic acquisitions and better service operations continue to support its growth trajectory, while colder temperatures and improved margins contribute to a positive outlook for fiscal 2025.

Potential Investment Opportunities

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Star Group, L.P. (SGU): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.