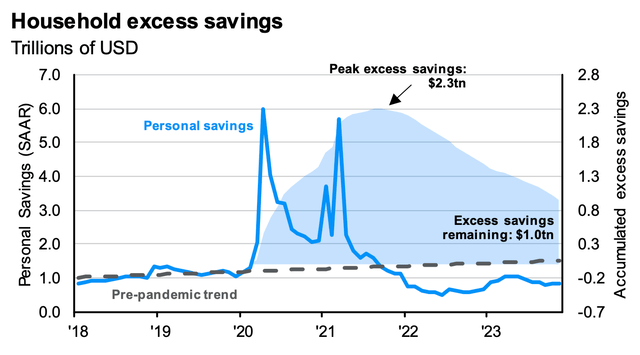

JPMorgan calculates that consumers still retain about $1 trillion in excess savings from the pandemic. Recent US Retail Sales reports have been robust, although holiday spending fell slightly below estimates (+3.1% as reported by Mastercard SpendingPulse versus the +3% to +4% National Retail Federation forecast). Furthermore, there has been soft data from China recently, posing a challenge to large multinational consumer companies with a significant presence in that region.

Despite these mixed indicators, I reaffirm my buy rating on Starbucks (NASDAQ:SBUX). I see shares as undervalued, with the company’s growth trajectory on a strong footing. However, bulls still have some technical work cut out to bolster the momentum.

Consumers Holding Excess Savings, Fueling Retail Sales Growth

Bank of America Global Research states that SBUX is the world’s leading coffee retailer, operating over 29,000 global locations, with approximately half being company-owned and half licensed. The company purchases and roasts high-quality whole bean coffees and offers a range of beverages and food items. Starbucks has also diversified beyond its core retail business into consumer products, leveraging its strong brand equity.

The $106 billion market cap company, based in Seattle, operates in the Restaurants industry within the Consumer Discretionary sector. It trades at a near-market 22.5 forward 12-month non-GAAP price-to-earnings ratio and pays a below-market 1.3% dividend yield. Shares trade with an implied volatility percentage of 28% while short interest on the stock is low at just 1.3% as of January 5, 2024, ahead of its upcoming earnings release.

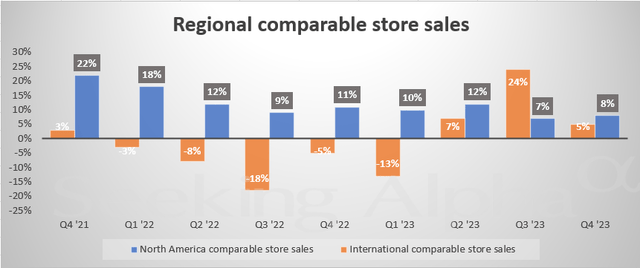

In November, Starbucks reported strong Q4 2023 results. Non-GAAP EPS verified at $1.06, exceeding the Wall Street consensus estimate of $0.97, while $9.4 billion of revenue, up 11% from year-ago levels, surpassed expectations. Comp-store sales globally rose by 8%, with strong performance in its North American segment.

Global locations surpassed 38,000 for the first time. The clean EPS beat included better-than-expected margins (18.2% versus 17.4% consensus), and North American EBITDA was quite high at 23.2%, indicating that labor productivity enhancement efforts paid off. Despite challenges in China, the company achieved 5% same-store sales growth there, led by better transaction volume.

Starbucks: Robust Comp-Store Sales Growth in North America

The management team anticipates 7% to 9% same-store sales growth for 2024, with strong EPS growth expected in the range of +15% to +20%. However, Starbucks has revised its profit growth outlook to 15% for 2024. Key to watch at its upcoming earnings release will be the progress of cost-saving initiatives, with the aim of reducing costs by $3 billion over the next three years, primarily focusing on lowering COGS and G&A expenses. These savings are then expected to be reinvested through new growth strategies, store renovations, and new equipment investments.

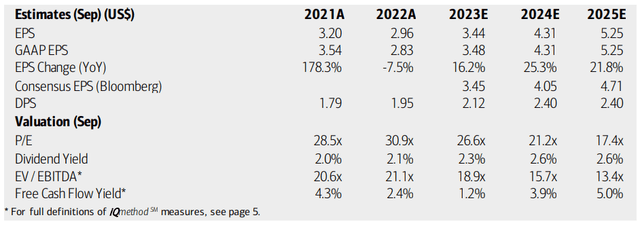

On thevaluation front, analysts at BofA anticipate earnings to rise by more than 25% this year, with out-year EPS estimates showing continued growth above 20%. The current consensus reveals mid-to-high teens EPS growth through 2026 with top-line growth hovering at a strong 10%.

Dividends are forecasted to rise to $2.40 annually (the current payout is $0.57 per quarter). The appealing aspect about SBUX today is its lower earnings multiple, while free cash flow remains healthy. However, its EV/EBITDA ratio is higher than that of the S&P 500.

Starbucks: Earnings, Valuation, Dividend Yield, Free Cash Flow Projections

If we assume $4.25 of operating earnings per share over the coming 12 months and apply a 28 multiple (below its long-term average of 36), then the stock should trade near $119. The PEG ratio is quite favorable at 1.4 compared to a 5-year normal of 2.52.

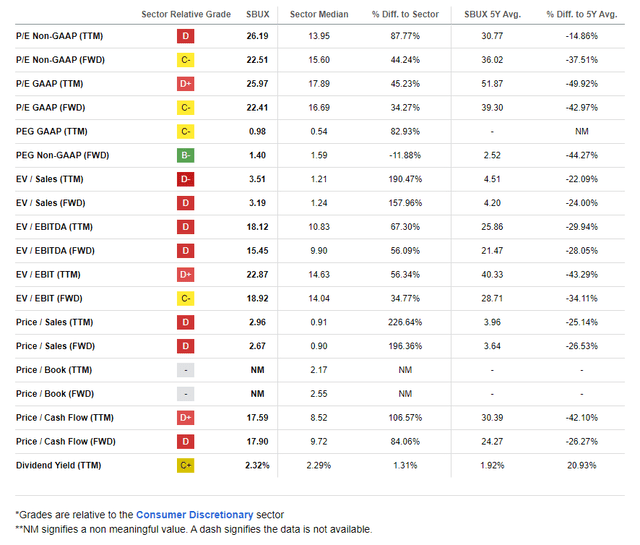

Starbucks: Attractively Priced Relative to Historical Trends

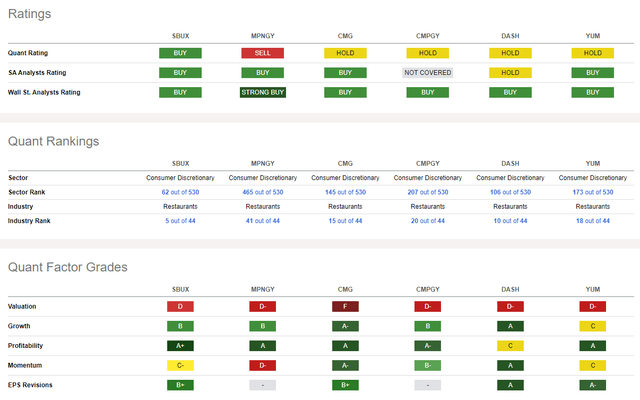

Compared to itspeers, Starbucks features a valuation that is actually about in-line. Additionally, with a solid growth history and outlook, as well as best-in-class profitability trends and soundly positive EPS revisions, the technical momentum situation is less than optimal.

Comparative Analysis of Competitors

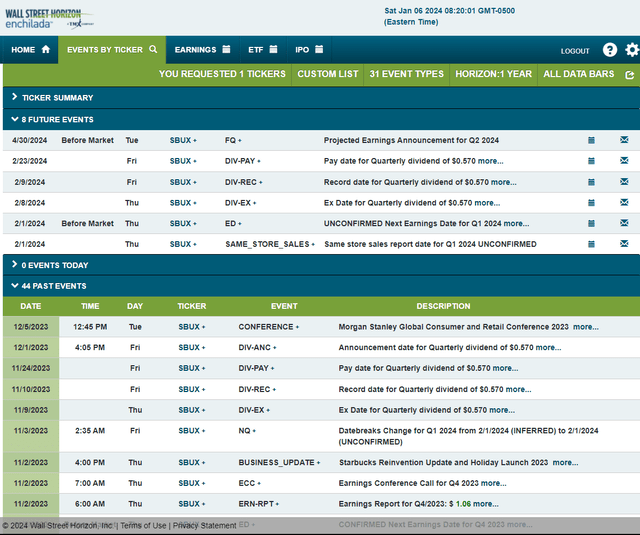

Looking ahead, corporate event data provided by Wall Street Horizon indicate an unconfirmed Q1 2024 earnings date of Thursday, February 1 BMO. Starbucks also reports same-store sales data in that release. Shares will trade ex a $0.37 dividend on Thursday, February 8.

Potential Business Event Risks

Starbucks Stocks: Underwhelming Steep Decline or Hidden Opportunity?

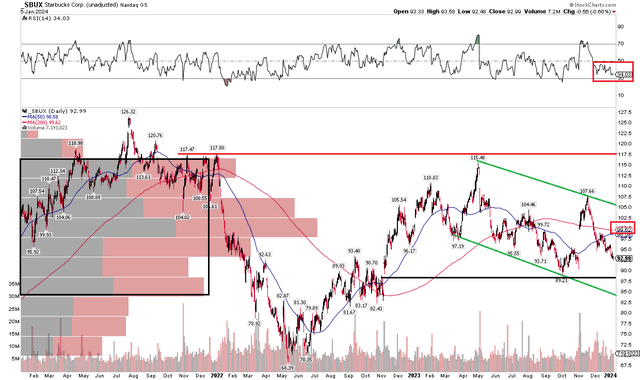

The Technical Analysis

When scrutinizing Starbucks (SBUX) technicals, a pattern of fluctuating earnings and macro risks emerges. The stock price suffered a setback after encountering resistance in the mid-$110s. This particularly troublesome spot for the bulls in late 2021 effectively sliced the stock in half by its May 2022 nadir. It’s noteworthy that SBUX hit rock bottom ahead of the S&P 500’s June low in that year, and despite the consumer stock’s failure to plummet to new lows the following October, this did not serve as a strong indication of relative strength. The favorable price action eventually dwindled, and SBUX has since trailed behind. As of late, a downward-trending channel is visibly in place, with current support observed around $85 – also marking the level where shares consolidated before the breakout in November 2022.

In the grand scheme of things, with a flat to slightly downtrending long-term 200-day moving average, the bears have managed to wrest some control over SBUX stock. This hypothesis is reinforced by the RSI momentum oscillator perched atop the chart, firmly entrenched in bearish territory. Last but not least, with significant volume by price from the low $80s up to the mentioned resistance zone near $115, a rigorous tussle between the bulls and bears is expected to unfold.

Presently, the momentum is rather tepid, with support evident in the mid-$80s while resistance is capped at $115 to $117.

Declining SBUX: Bearish Trend and Resistance at $115 to $117

The Verdict

I am steadfast in my recommendation to buy SBUX. While the stock has floundered since Q2 of last year, I foresee fundamental potential given its modest valuation, albeit the technicals are alarmingly feeble ahead of the Q1 2024 results scheduled for release on February 1.