Starbucks (NASDAQ: SBUX) is an undeniable giant on the global stage. With nearly 39,000 locations worldwide and a strong foothold in China, the company’s growth trajectory has been nothing short of meteoric, ushering it into the ranks of the most iconic brands worldwide.

As Starbucks solidifies its position as a mature behemoth, questions emerge about its ability to sustain and surpass market expectations. The looming shadow of market saturation in some regions casts doubt on its capacity to outperform its competitors and continue its upward trajectory.

Challenges and Opportunities for Starbucks’ growth

Despite its well-established presence, Starbucks operates in an industry ripe with growth potential. The specialty coffee market, projected to rise by 11% annually until 2030 according to Grand View Research, offers a promising landscape for Starbucks to explore.

CEO Laxman Narasimhan envisions Starbucks expanding its footprint to 55,000 locations by 2030, capitalizing on its extensive global reach. However, navigating the saturated U.S. market and contending with formidable foes such as independents, Dunkin’, Dutch Bros, and even the emerging McDonald’s beverage chain poses formidable challenges.

With China as its second-largest market, Starbucks faces intense competition from Luckin Coffee and other players, emphasizing the critical need to fortify its iconic brand and retain customer loyalty in a cutthroat industry.

Financial Performance Comparison

In the first quarter of fiscal 2024, Starbucks reported an 8% year-over-year revenue increase, amounting to $9.4 billion. Although this marks a slight deceleration compared to the 12% growth in fiscal 2023, the 5% surge in comparable store sales during fiscal Q1 is a positive indicator.

Net earnings for the same period climbed by 20% to slightly over $1 billion, attributed to operating expenses growing at a slower pace than revenue. Despite these gains, the rate of profit growth may be on a downward trend, following a robust 26% increase in fiscal 2023.

Starbucks’ counterpart, Dutch Bros, achieved a remarkable 31% revenue growth in 2023 by executing a strategic regional-to-national expansion plan. However, Dutch Bros lags in same-shop sales growth compared to Starbucks, and the absence of dividends detracts from its appeal to income-oriented investors.

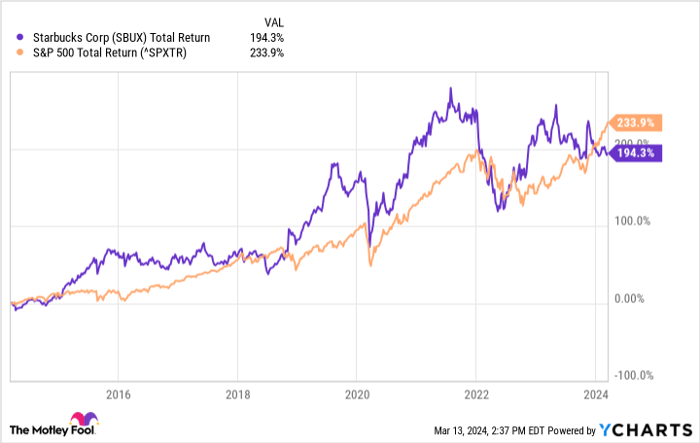

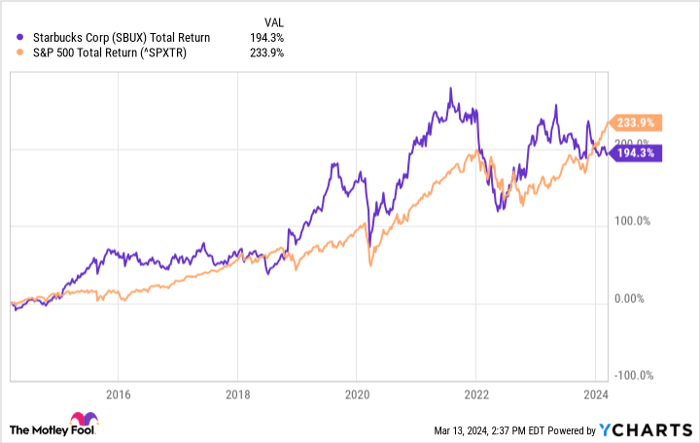

While Starbucks offers a 2.5% dividend yield, steadily increasing since its inception in 2010, Dutch Bros marginally outperforms Starbucks in stock performance. Despite its attractive P/E ratio of 25, Starbucks has struggled to deliver returns surpassing the S&P 500 in recent years.

SBUX Total Return Level data by YCharts

Evaluating Starbucks Stock: Hold, Buy, or Sell?

Given the current landscape, prudent investors may opt to retain Starbucks stock. Its extensive market presence and robust global brand serve as pillars of stability, complemented by consistent revenue and store sales growth against fierce competition.

Nonetheless, the escalating competitive pressure from rivals like Dutch Bros and the incipient McDonald’s beverage venture, coupled with its lackluster performance vis-à-vis the S&P 500, warrant caution. Dutch Bros’ ambitious expansion strategy may offer more allure to growth-minded investors.

While existing Starbucks shareholders stand to benefit from ongoing expansions and rising dividends, prospective investors might find greater appeal in the S&P 500 or the burgeoning competition in the coffee market.

Should you invest $1,000 in Starbucks right now?

Before contemplating Starbucks stock, consider this:

The Motley Fool Stock Advisor team identified the 10 best stocks for future investment, with Starbucks not making the cut. These top picks offer potential for substantial returns in the years ahead.

Stock Advisor equips investors with a roadmap for success, featuring portfolio construction tips, analyst insights, and bi-monthly stock recommendations, outperforming the S&P 500 multiple times since 2002*.

Explore the 10 recommended stocks

*Stock Advisor returns as of March 11, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Luckin Coffee and Starbucks. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.