“`html

The Stock Market’s Volatile Journey Since Trump’s Election

Editor’s note: “Stay Ahead of Stock Market Volatility With An Outperforming Strategy” was previously published in February 2025 with the title, “An Outperforming Investment Tool to Help You Game the Market.” It has since been updated to include the most relevant information available.

Since Donald Trump’s election win, the U.S. Stock market has witnessed significant volatility.

Over the past few months, we have observed:

- One of the fastest 10% drops in market history.

- After the announcement of the “Liberation Day” tariffs on April 2, the S&P 500 fell sharply, plummeting over 12.1% in just four sessions.

- One of the worst two-day crashes in recent history.

- On April 3-4, the market experienced a 10.5% decline, marking the fourth worst two-day stretch since 1950.

- One of the best single-day rallies.

- In response to President Trump’s announcement of a 90-day pause on recently implemented tariffs, the S&P climbed 9.5% on April 9, representing its strongest one-day performance since October 2008.

- One of the longest win streaks.

- On May 2, the S&P achieved its ninth consecutive day of gains—its longest winning streak in over 20 years—gaining approximately 10% in that period.

- One of the highest readings for the volatility index.

- The CBOE Volatility Index (VIX), often dubbed the market’s “fear gauge,” nearly doubled over six months, hitting a reading of 27.86.

Amid this turbulence, investors are keenly interested in what the next four years will hold for stocks during “Trump 2.0.” Will this unpredictability be our new normal?

Possible. My advice for this era can be summarized in six words: embrace the boom, beware the bust.

Embrace the Boom; Beware the Bust

Driven largely by the AI investment megatrend, the U.S. Stock market has been on an upward trajectory for the past two years.

The surge in artificial intelligence has ignited remarkable investment activity. Major companies like Meta (Stock-ticker”>META), Microsoft (Stock-ticker”>MSFT), Amazon (Stock-ticker”>AMZN), and Alphabet (Stock-ticker”>GOOGL) are investing billions to develop AI infrastructure, applications, and talent. This influx of capital has fueled a significant economic boom.

The outcome? Stocks have been soaring for two years.

From its lows in October 2022 to its peak in early February, the S&P 500 jumped more than 70%. This impressive rally was supported by back-to-back years of market gains exceeding 20%.

Stock market over time” class=”aligncenter wp-image-3288427″ srcset=”https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025.png 869w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-300×125.png 300w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-768×321.png 768w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-200×84.png 200w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-400×167.png 400w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-116×48.png 116w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-100×42.png 100w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-120×50.png 120w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-78×33.png 78w” sizes=”(max-width: 869px) 100vw, 869px”>

Stock market over time” class=”aligncenter wp-image-3288427″ srcset=”https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025.png 869w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-300×125.png 300w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-768×321.png 768w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-200×84.png 200w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-400×167.png 400w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-116×48.png 116w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-100×42.png 100w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-120×50.png 120w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-78×33.png 78w” sizes=”(max-width: 869px) 100vw, 869px”> Stock market over time” class=”aligncenter wp-image-3288427″ srcset=”https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025.png 869w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-300×125.png 300w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-768×321.png 768w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-200×84.png 200w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-400×167.png 400w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-116×48.png 116w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-100×42.png 100w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-120×50.png 120w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-78×33.png 78w” sizes=”(max-width: 869px) 100vw, 869px”>

Stock market over time” class=”aligncenter wp-image-3288427″ srcset=”https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025.png 869w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-300×125.png 300w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-768×321.png 768w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-200×84.png 200w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-400×167.png 400w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-116×48.png 116w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-100×42.png 100w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-120×50.png 120w, https://investorplace.com/wp-content/uploads/2025/05/spx-2022-2025-78×33.png 78w” sizes=”(max-width: 869px) 100vw, 869px”>In 2023, the S&P rose by 24%, followed by another 23% in 2024. This marks only the fourth instance since the Great Depression—almost a century ago—of the index achieving back-to-back gains exceeding 20%.

Clearly, we experienced a Stock market boom.

We believe this boom may be set to accelerate even further.

Signs Indicating the Rally May Be Resuming

While stocks have faced a rocky start in Trump’s second term, we contend that the economic upturn may not be over.

Instead, we argue the current Stock market boom that propelled us through 2023 and 2024 may be reigniting in May 2025 for multiple reasons:

- The AI Boom, which fueled the previous market rally, remains robust.

- Inflation pressures have been contained, with the U.S. inflation rate easing to 2.4% for the 12 months ending March 2025, down from 2.8% in February.

- The labor market is stable. As of April 2025, the unemployment rate was 4.2%, consistently within the 4.0% to 4.2% range held since May 2024.

- Consumer spending continues, albeit more cautiously.

- Tariff discussions are pivoting towards trade agreements. Recently, the U.S. reached a deal with the U.K. that removes tariffs on U.K. steel, aluminum, and car exports, while the U.K. relaxed tariffs on U.S. ethanol and beef.

- Rate cuts are anticipated. Economists…

“`Market Predictions Indicate Potential Rate Cuts and Tax Changes Ahead

- Analysts from JPMorgan Chase and Goldman Sachs foresee interest rate cuts by the Federal Reserve starting in 2025, with the first reduction likely by June.

- Anticipated tax cuts, along with regulatory rollbacks, may extend the 2017 Tax Cuts and Jobs Act. This extension could lower federal tax revenue by $4.5 trillion between 2025 and 2034, potentially boosting long-run GDP by 1.1%.

Given these factors, equities may be poised for upward momentum in the upcoming months and years.

While this situation sounds promising, it’s crucial to remember that market booms often precede busts. The question isn’t “if” a downturn will occur, but “when.”

Historical Insights on Stock Market Trends

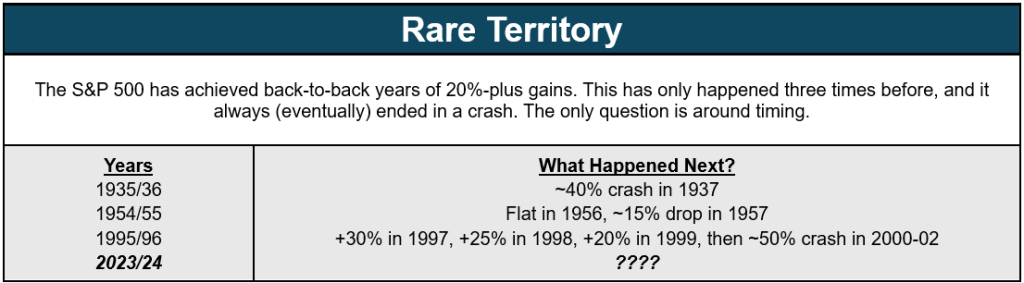

The stock market recently recorded back-to-back years of over 20% gains, a feat accomplished only three times before: in 1935/36, 1954/55, and 1995/96.

After the market gains in 1935 and ‘36, a sharp decline followed, resulting in a 40% drop in 1937. A similar trend occurred after the 1954/55 boom, where stocks stagnated in 1956 and then fell by 15% in 1957. Post-1995/96, stocks continued to rise through 1999, only to plummet nearly 50% in the following years.

Such market trends indicate that rapid increases can quickly shift to declines.

This prompts the question: should investors pull out now to avoid potential losses?

Not at all.

Strategies for Navigating the Stock Market

Just as the final segments of a movie often provide the most excitement, the concluding years of a market boom may yield significant profits.

For instance, during the Dot Com Boom of the 1990s, the Nasdaq Composite delivered remarkable returns, culminating in a nearly 90% surge in 1999. However, this period ended with a steep downturn in 2000.

The lesson here is clear: exiting the market early can cost potential gains, but staying too long can increase risks.

So, how should investors navigate this landscape?

Embrace the growth, remain cautious of an impending downturn, and monitor market signals to exit strategically.

This strategy is challenging, which is why resources like Auspex can be beneficial. This algorithmic stock screener evaluates thousands of stocks each month, identifying those most likely to rise in the near future.

This tool identifies stocks based on stringent criteria, focusing only on those with positive fundamentals, technicals, and sentiment. A team assesses the final selections to prepare monthly “Auspex picks.”

By utilizing this approach, investors can capitalize on market gains while protecting against downturns.

As of the publication date, Luke Lango held no positions in the securities mentioned.

Questions or feedback? Contact us at [email protected].