“`html

On September 15, 2025, Stephens & Co. upgraded C4 Therapeutics (NasdaqGS: CCCC) from Equal-Weight to Overweight. The average one-year price target for the company is $14.79/share, indicating a 313.71% potential upside from its last closing price of $3.58/share.

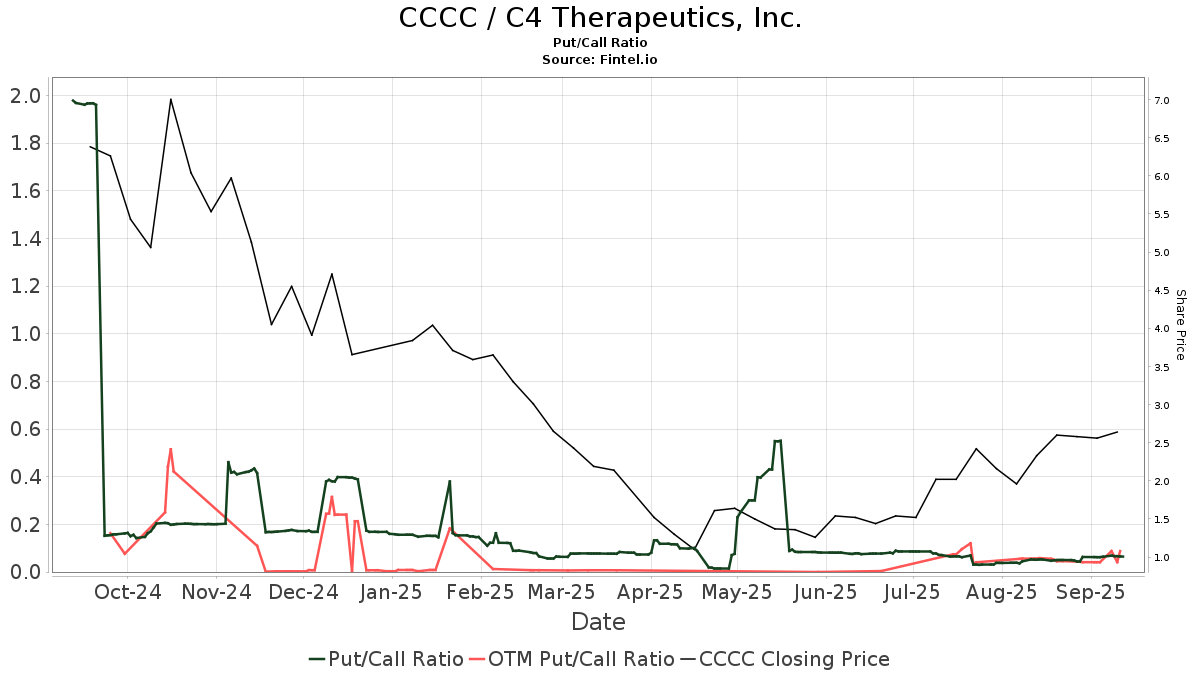

The projected annual revenue for C4 Therapeutics is $39 million, a 13.19% increase, while the projected annual non-GAAP EPS is -$2.88. Institutional ownership has decreased by 13.17% over the last quarter, with total shares owned dropping by 17.71% to 56.98 million shares. The put/call ratio stands at 0.06, reflecting a bullish outlook.

Key shareholders include Wasatch Advisors with 7.43 million shares (10.43% ownership), and WAMCX – Wasatch Ultra Growth Fund with 5.15 million shares (7.24% ownership), both showing recent increases in their allocations.

“`