Stephens & Co. Begins Coverage of Bicycle Therapeutics with Positive Outlook

On November 8, 2024, Stephens & Co. started covering Bicycle Therapeutics plc – Depositary Receipt (NasdaqGS:BCYC) with an Equal-Weight recommendation.

Analyst Price Forecast Indicates Significant Growth Potential

According to data as of October 22, 2024, the average one-year price target for Bicycle Therapeutics plc – Depositary Receipt is $40.06 per share. Predictions vary, with estimates ranging from a low of $28.28 to a high of $58.80. This average suggests a potential increase of 60.23% from the current closing price of $25.00 per share.

Discover companies with the highest upside potential on our leaderboard.

Revenue Expectations Drop While Losses Persist

Projected annual revenue for Bicycle Therapeutics plc – Depositary Receipt is $20 million, a decline of 46.96%. The expected annual non-GAAP earnings per share (EPS) is projected at -$5.09.

Institutional Investment Behavior

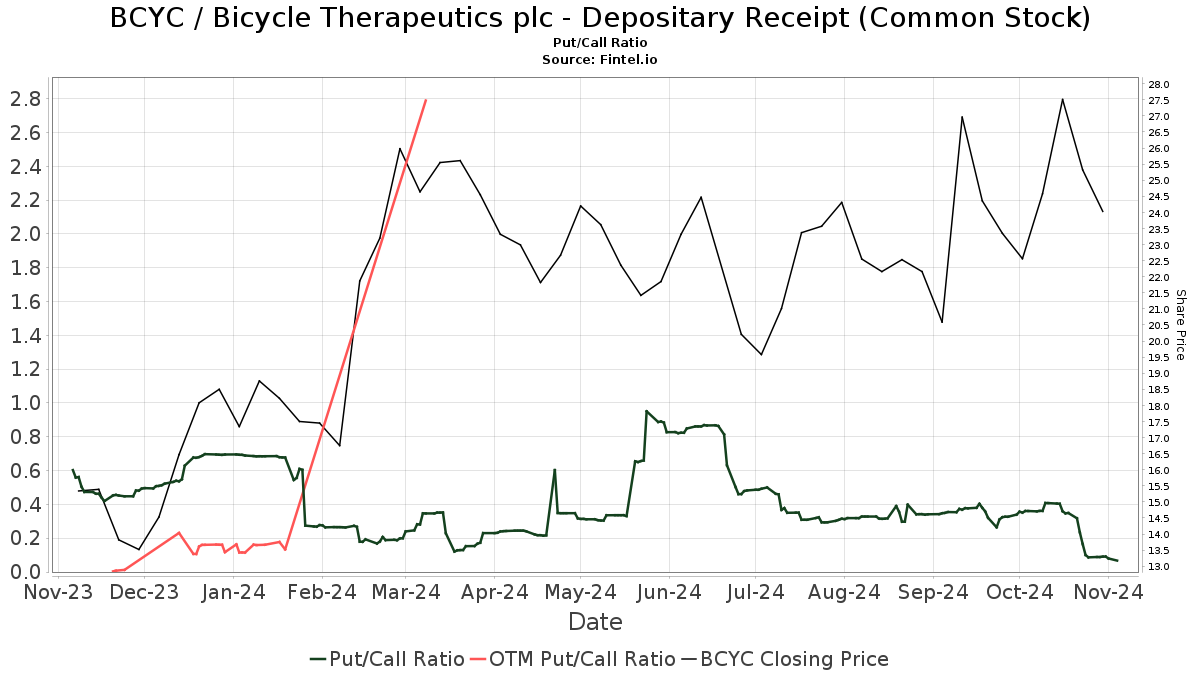

Currently, 147 funds or institutions have reported positions in Bicycle Therapeutics plc – Depositary Receipt, marking an increase of 18 owners (13.95%) compared to the previous quarter. The average investment weight across all funds dedicated to BCYC is 0.29%, reflecting a rise of 11.90%. Over the last three months, the total shares owned by institutions climbed 22.52% to reach 41,161,000 shares.  The put/call ratio for BCYC stands at 0.07, suggesting a bullish outlook among investors.

The put/call ratio for BCYC stands at 0.07, suggesting a bullish outlook among investors.

Recent Institutional Moves

Baker Bros. Advisors reported holding 9,400,000 shares, up from 4,943,000 shares in its prior filing, reflecting a substantial increase of 47.42%. Over the last quarter, their portfolio allocation in BCYC grew by 57.48%.

Deep Track Capital maintained its position with 3,491,000 shares, showing no changes over the last quarter.

Ra Capital Management increased its holdings from 800,000 to 2,253,000 shares, a remarkable rise of 64.49%. This firm’s portfolio allocation in BCYC jumped by 136.13% recently.

Fcpm Iii Services B.v. continues to hold 2,123,000 shares. Meanwhile, Armistice Capital increased its shareholdings from 1,672,000 to 1,972,000 shares, indicating a rise of 15.21%. However, they reduced their portfolio allocation in BCYC by 9.04% in the last quarter.

Background on Bicycle Therapeutics

(This description is provided by the company.)

Bicycle Therapeutics is a clinical-stage biopharmaceutical company focused on developing a new class of medicines known as Bicycles. These are fully synthetic short peptides designed for diseases that have limited treatment options. The unique structure of Bicycles enhances their ability to bind to targets with high affinity and specificity, making them promising candidates for drug development.

The firm’s lead candidate, BT1718, targets MT1-MMP and is currently undergoing a Phase I/IIa clinical trial in partnership with the Centre for Drug Development of Cancer Research UK. Additionally, BT5528, a second-generation candidate targeting EphA2, and BT8009, which targets Nectin-4, are both being evaluated in ongoing company-sponsored Phase I/II trials. Bicycle Therapeutics is based in Cambridge, UK, with key leadership team members based in Lexington, MA.

Fintel is a leading investment research platform serving individual investors, traders, financial advisors, and small hedge funds.

Our extensive data covers fundamentals, analyst reports, ownership statistics, fund sentiment, options sentiment, insider trading, and more. Enhanced stock picking is also available, powered by advanced quantitative models designed for optimal returns.

Click to Learn More.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.