California Resources Gains Favor with Analysts, Projected Growth Ahead

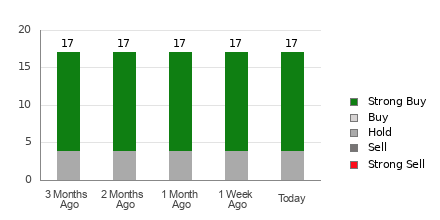

Fintel reports that on October 22, 2024, Stephens & Co. initiated coverage of California Resources (NYSE:CRC) with a Overweight recommendation.

Analyst Predictions Point to 20.66% Upside Potential

As of October 22, 2024, the average one-year price target for California Resources is $64.52 per share. The estimates range from a low of $57.57 to a high of $71.40. This average target suggests a potential increase of 20.66% from its last closing price of $53.47 per share.

See our leaderboard of companies with the largest price target upside.

Promising Financial Outlook Based on Projected Revenues

Analysts foresee California Resources achieving an annual revenue of $2,658 million, marking a 17.66% increase. Additionally, the projected annual non-GAAP EPS stands at $8.01.

Fund Ownership: A Closer Look

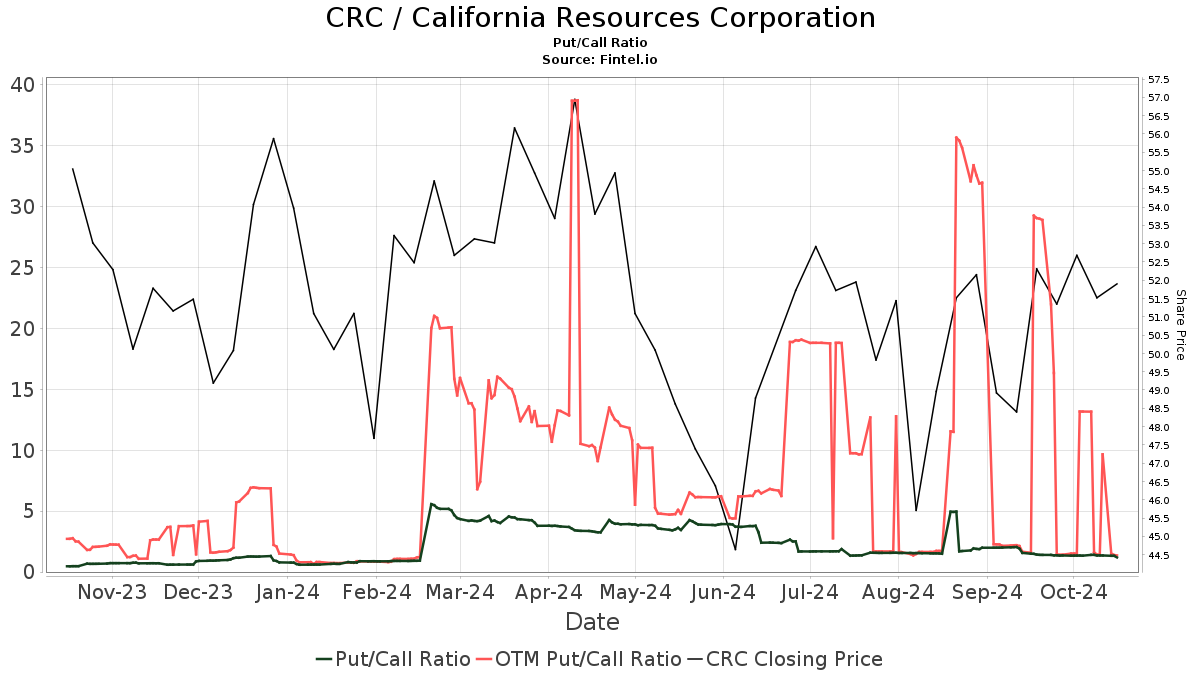

Currently, 700 funds or institutions report holding positions in California Resources, representing a decrease of 13 owners, or 1.82%, in the last quarter. The average portfolio weight of all funds dedicated to CRC rose by 1.78% to 0.32%. Total institutional shares increased by 0.31% over the last three months, reaching 88,985K shares.  The put/call ratio stands at 1.21, reflecting a bearish outlook.

The put/call ratio stands at 1.21, reflecting a bearish outlook.

Institutional Shareholder Activity

Gimbel Daniel Scott holds 6,247K shares, accounting for 7.00% ownership of the company, showing no change from the previous quarter.

First Trust Advisors increased its holdings from 4,565K shares to 5,639K shares, which is a rise of 19.04%, representing 6.32% ownership. This highlights an overall allocation increase in CRC by 19.70% over the last quarter.

The RDVY – First Trust Rising Dividend Achievers ETF holds 4,400K shares, reflecting a 4.93% ownership. In its prior filing, the firm reported holding 3,727K shares, which is an increase of 15.30%. The allocation in CRC also rose by 11.48% over the last three months.

IJR – iShares Core S&P Small-Cap ETF shows a slight decrease in shares, holding 4,163K shares, down 4.78% from 4,362K shares. The firm reduced its portfolio commitment in CRC by 4.26% over the previous quarter.

CALF – Pacer US Small Cap Cash Cows 100 ETF increased its share ownership from 2,307K shares to 3,561K shares, a 35.22% increase, indicating a rise of 39.96% in its allocation in CRC over the last quarter.

About California Resources Corporation

(This description is provided by the company.)

California Resources Corporation is the largest company focused on oil and natural gas exploration and production in California. The company operates solely within the state, utilizing integrated infrastructure to gather, process, and market its production. By leveraging advanced technology, it aims to safely and responsibly supply affordable energy for Californians.

Fintel is a premier investing research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Exclusive stock picks are driven by advanced, backtested quantitative models aimed at improving profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.