Immunome Gains Momentum: Analyst Initiates Coverage with Promising Outlook

Fintel reports that on November 8, 2024, Stephens & Co. initiated coverage of Immunome (NasdaqCM:IMNM) with a Overweight recommendation.

Analysts Predict Significant Growth in Immunome’s Stock

As of October 22, 2024, the average one-year price target for Immunome stands at $32.90 per share, with estimates varying from a low of $23.23 to a high of $39.90. This average suggests an increase of 153.43% from its latest closing price of $12.98 per share.

Fund Sentiment Points to Growing Interest

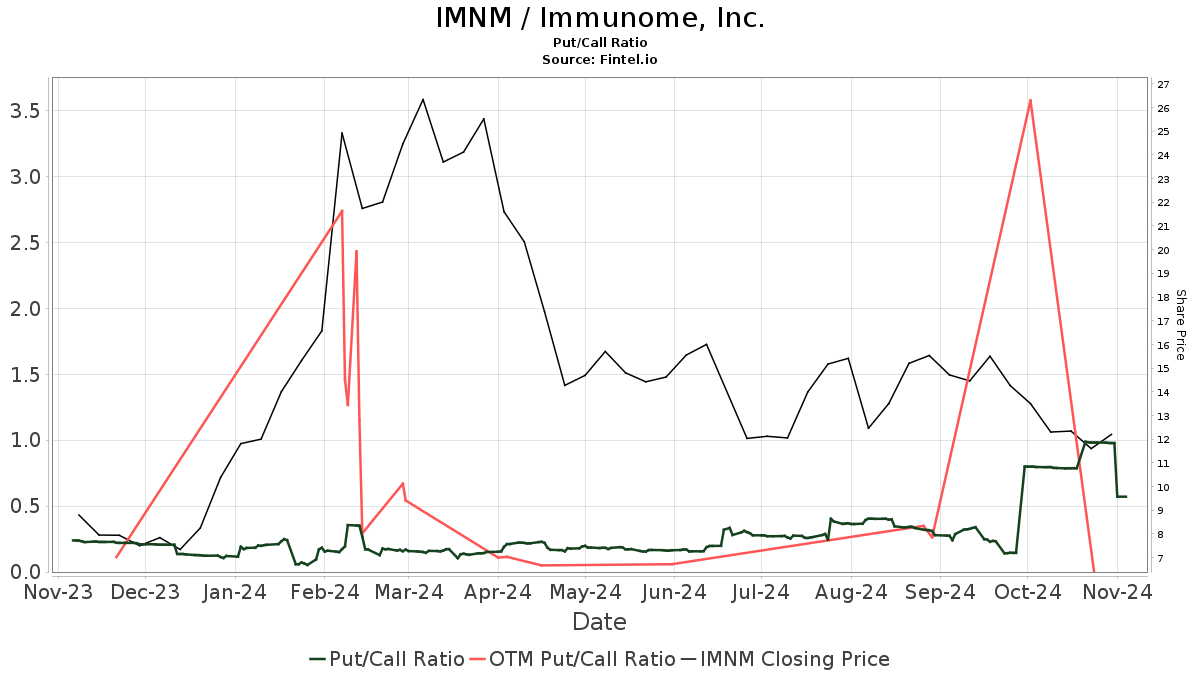

Currently, 219 funds or institutions report positions in Immunome, marking an increase of 46 owners, or 26.59%, in the last quarter. The average portfolio weight of all funds dedicated to IMNM is 0.09%, which represents a rise of 40.31%. Over the past three months, total shares owned by institutions surged by 30.69%, totaling 51,214K shares.  The put/call ratio of IMNM is 0.50, indicating a bullish stance among investors.

The put/call ratio of IMNM is 0.50, indicating a bullish stance among investors.

What Other Shareholders Are Up To

Redmile Group owns 4,890K shares of Immunome, constituting 8.08% of the company, with no changes from the previous quarter.

EcoR1 Capital also holds 3,879K shares, representing 6.41% ownership, a figure that has remained stable in the last quarter.

T. Rowe Price Investment Management has increased its stake, now holding 3,879K shares—an increase of 60.90% from 1,516K shares in its prior filing. Their portfolio allocation has grown by 29.35% over the previous quarter.

Janus Henderson Group holds 3,164K shares, indicating a 51.37% increase from their previous 1,538K shares, though their overall portfolio allocation has seen a slight reduction of 1.05% last quarter.

Price T Rowe Associates has decreased its stake from 2,246K shares to 2,021K shares, representing an 11.11% decline and a substantial portfolio allocation decrease of 56.92% over the last three months.

Understanding Immunome’s Mission

Immunome Background Information

(This description is provided by the company.)

Immunome is a biopharmaceutical company leveraging a proprietary human memory B cell platform to discover and develop unique antibody therapeutics. These novel treatments aim to transform the approach to diseases, primarily focusing on oncology and infectious diseases, including COVID-19. The company’s advanced discovery engine targets therapeutic antibodies sourced from memory B cells of patients, whose immune systems have successfully fought off disease.

Fintel is one of the most comprehensive investing research platforms for individual investors, traders, financial advisors, and small hedge funds. Our extensive database includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.