Stifel Begins Coverage of ResMed Inc. with a Hold Rating

Analyst Forecast Indicates Modest Growth Ahead

Fintel reports that on December 13, 2024, Stifel initiated coverage of ResMed Inc. – Depositary Receipt (ASX:RMD) with a Hold recommendation. As of December 3, 2024, the average one-year price target for ResMed Inc. is $39.28 per share, signaling a potential increase of 4.32% from its latest closing price of $37.65 per share. Price forecasts vary, showing a low of $29.59 and a high of $45.82.

Projected Revenue and Earnings

The expected annual revenue for ResMed Inc. stands at $4,828 million, reflecting a slight increase of 0.43%. Analysts project a non-GAAP earnings per share (EPS) of 8.23.

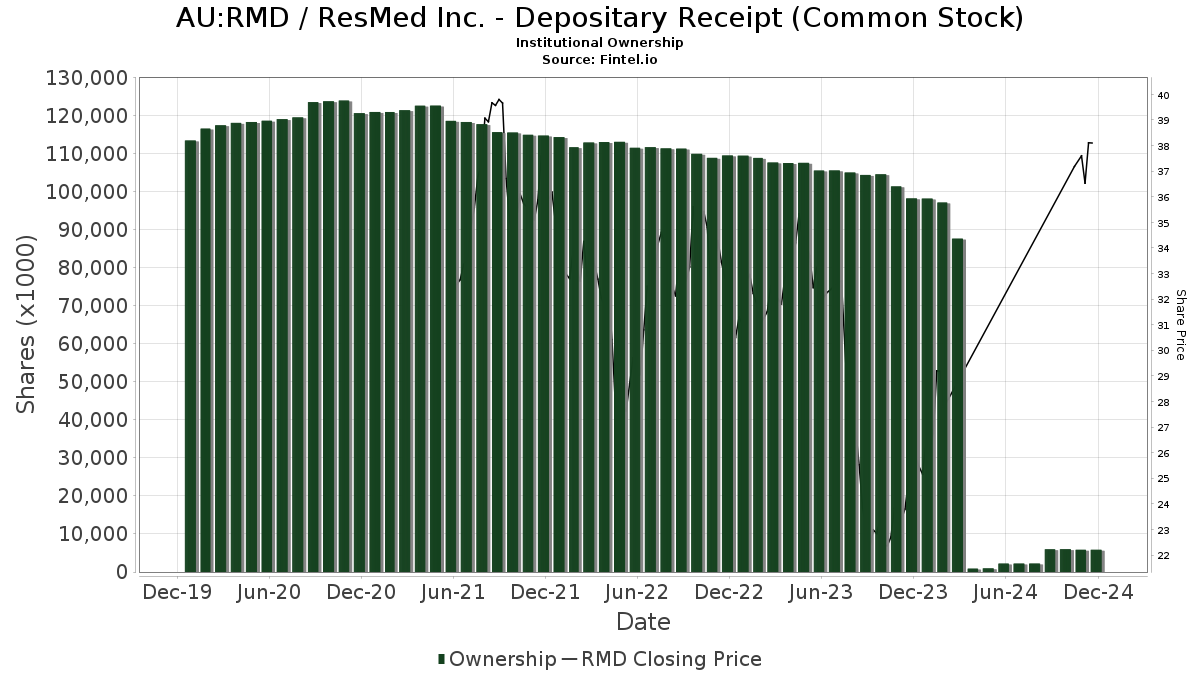

Institutional Investment Trends

Currently, nine funds and institutions hold positions in ResMed Inc. – Depositary Receipt. This number has remained stable over the past quarter. The average portfolio weight dedicated to RMD among these funds is 1.82%, marking a 12.54% rise. However, total shares owned by institutions dipped 2.22% over the last three months to 5,841,000 shares.

Recent Changes in Shareholding

Bernstein Fund Inc’s International Strategic Equities Portfolio SCB Class holds 4,994,000 shares, unchanged from the previous quarter. AB VARIABLE PRODUCTS SERIES FUND, INC. – AB International Value Portfolio reduced its holdings from 306,000 to 285,000 shares, which represents a decrease of 7.36%. However, this firm boosted its portfolio allocation in RMD by 16.35% over the same period.

The Aberdeen Australia Equity Fund increased its shareholding from 213,000 to 235,000 shares, an uptick of 9.60%, with a portfolio allocation increase of 1.84%. ABIAX – AB International Value Fund maintained its stake of 107,000 shares, showing a minor increase of 0.09%, while also increasing its allocation by 12.44%. SINE – Martin Currie Sustainable International Equity ETF held steady at 80,000 shares, with no changes in the last quarter.

Fintel stands out as a robust investing research platform, providing individual investors, traders, financial advisors, and small hedge funds with comprehensive data on fundamentals, analyst reports, and fund sentiment.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.