Stifel Initiates Coverage of ResMed Inc. with Hold Recommendation

Analyst Forecast Indicates Potential for 20.17% Growth

On December 13, 2024, Stifel began analyzing ResMed Inc. – Depositary Receipt (OTCPK:RSMDF), giving it a Hold rating. As of October 4, 2023, the average one-year price target for ResMed is set at $21.27 per share. The estimates range from a low of $16.58 to a high of $27.88. This target suggests a possible increase of 20.17% from its most recent closing price of $17.70 per share.

Revenue Projections and Earnings

The expected annual revenue for ResMed is projected at $4,363 million, reflecting a decrease of 9.25% compared to previous estimates. The anticipated non-GAAP earnings per share (EPS) stands at 7.40.

Funds Showing Interest in ResMed

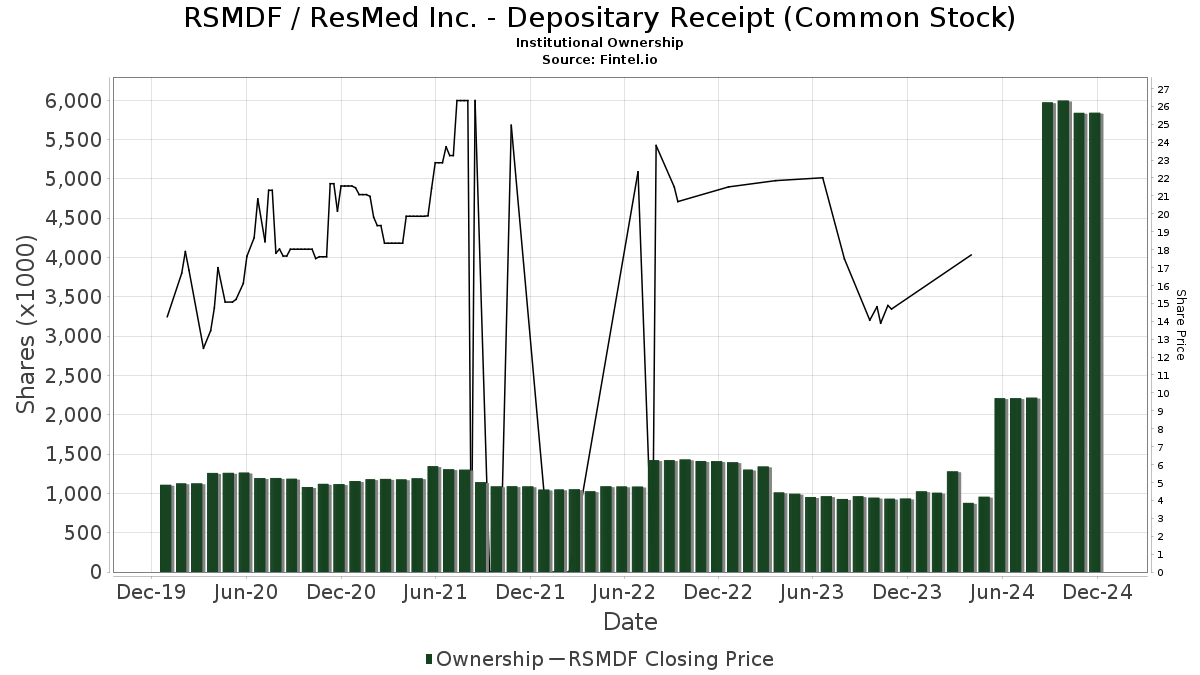

Nine funds or institutions currently hold positions in ResMed, with this number remaining consistent over the last quarter. The average portfolio weight for these funds dedicated to RSMDF has increased by 12.54% to 1.82%. However, institutional ownership fell by 2.22%, bringing the total shares held to 5,841,000 over the past three months.

Current Institutional Holdings

Among the notable institutional investors, Bernstein Fund Inc – International Strategic Equities Portfolio SCB Class retains 4,994,000 shares, with no changes noted in the last quarter. Meanwhile, AB VARIABLE PRODUCTS SERIES FUND, INC. – AB International Value Portfolio reports a decrease of 7.36%, holding 285,000 shares down from 306,000 previously; however, its overall portfolio share allocation to RSMDF rose by 16.35%.

Aberdeen Australia Equity Fund has increased its holdings from 213,000 to 235,000 shares, marking a 9.60% rise in its portfolio allocation to RSMDF. ABIAX – AB International Value Fund has maintained its position with 107,000 shares, having just a slight increase of 0.09% in its allocation. Additionally, SINE – Martin Currie Sustainable International Equity ETF’s holdings remain unchanged at 80,000 shares.

Fintel offers one of the most thorough investing research platforms available to investors, traders, financial advisors, and small hedge funds. Our resources include comprehensive data on fundamentals, analyst insights, ownership statistics, fund sentiment, and much more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.