Stifel Downgrades Vertex Outlook Amid Institutional Activity

Fintel reports that on February 28, 2025, Stifel downgraded their outlook for Vertex (LSE:0A3L) from Buy to Hold.

Changes in Fund Sentiment

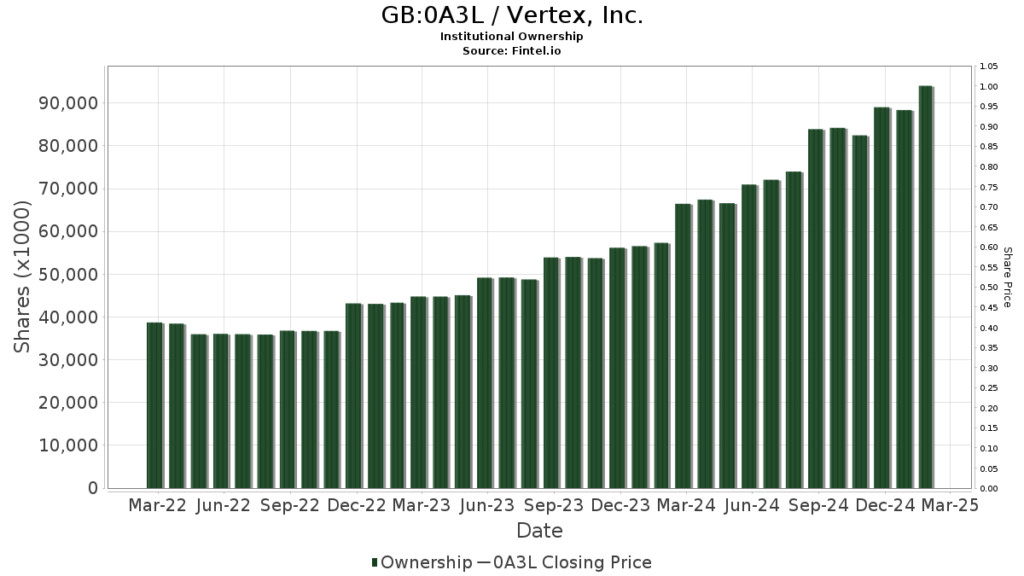

Currently, 535 funds or institutions report their positions in Vertex, marking an increase of 65 owners, or 13.83%, in the last quarter. The average portfolio weight of all funds dedicated to 0A3L is now 0.38%, which represents a 10.50% increase. Over the past three months, institutions have increased their total shares owned by 10.77% to 95,937K shares.

Institutional Shareholder Actions

Tensile Capital Management holds 3,770K shares, which represents 5.71% ownership of the company. In its previous filing, the firm reported owning 4,054K shares, indicating a decrease of 7.53%. However, it has increased its portfolio allocation in 0A3L by 23.79% over the last quarter.

Neuberger Berman Group holds 3,528K shares, representing 5.35% ownership. Previously, the firm reported owning 3,474K shares, reflecting an increase of 1.53%. Nonetheless, the firm decreased its portfolio allocation in 0A3L by 25.53% over the last quarter.

NBGNX – Neuberger Berman Genesis Fund Investor Class owns 2,297K shares, equating to 3.48% ownership. This is unchanged from its prior report, where it held the same number of shares, indicating an increase of just 0.01%. The portfolio allocation in 0A3L was increased by 30.00% last quarter.

Conestoga Capital Advisors holds 2,262K shares, which represents 3.43% ownership. Previously, the firm reported owning 2,280K shares, showing a decrease of 0.83%. The portfolio allocation in 0A3L has been increased by 34.21% over the last quarter.

Franklin Resources possesses 2,129K shares, accounting for 3.23% ownership of Vertex. In its prior report, the firm indicated ownership of 1,690K shares, reflecting an increase of 20.62%. However, it has decreased its portfolio allocation in 0A3L by 72.30% over the last quarter.

Fintel is recognized as one of the most comprehensive research platforms available, serving individual investors, traders, financial advisors, and small hedge funds.

Our global data includes fundamentals, analyst reports, ownership data, and fund sentiment, along with options sentiment, insider trading, options flow, unusual options trades, and additional valuable information. Furthermore, our exclusive Stock picks leverage advanced, backtested quantitative models to enhance profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.