Serve Robotics Faces Significant Challenges Amid Stock Decline

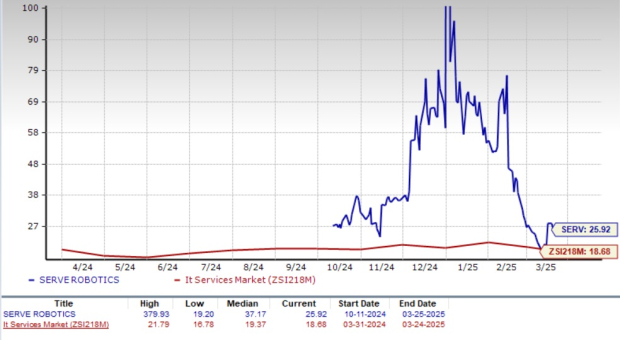

Serve Robotics (SERV) has seen its shares decline by 52.9% over the past three months. This performance is notably worse than the declines experienced by the Zacks Computer & Technology sector, the Zacks IT Services industry, the Technology Select Sector SPDR Fund (XLK), and the S&P 500 index, which fell by 8.4%, 13.3%, 8.1%, and 3.8%, respectively.

The sharp drop raises a critical question: Should investors continue to hold their position in this early-stage company, or is it time to exit SERV stock altogether?

SERV Three-Month Price Performance Chart

Image Source: Zacks Investment Research

Factors Contributing to Serve Robotics’ Decline

Recent tariff increases, enacted by the Trump administration, have raised investor concerns about Serve Robotics’ ability to deploy 2,000 robots by the end of 2025. These tariffs could disrupt SERV’s supply chain, driving up costs and potentially hindering its expansion plans.

The situation is compounded by rising costs and reduced consumer spending faced by SERV’s main customers—restaurants—which limits the uptake of SERV’s robotic fleet. In addition, SERV’s latest financial results have intensified concerns among investors.

For instance, SERV reported a loss of 36 cents per share in the fourth quarter of 2024, which exceeded the Zacks Consensus Estimate loss of 19 cents. Moreover, analysts have downgraded 2025’s loss estimates by 17 cents to a projected loss of 83 cents per share, signaling near-term pessimism regarding the stock.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Customer Concentration Risks for Serve Robotics

As of December 31, 2024, SERV operated a fleet of 100 robots, with a staggering 91% of total revenues coming from just two major clients: Magna and Uber. This heavy reliance on a small customer base makes SERV particularly vulnerable; losing just one client could lead to drastic declines in sales and profitability.

Additionally, this concentration limits SERV’s negotiating power, which can reduce profit margins—a trend already reflected in its financial history, since the company has never posted a profit since its inception in 2021.

To mitigate these risks, SERV is investing heavily in research and development, fleet expansion, and scaling operations for better unit economics. However, these strategies may strain margins further, keeping the company in a cycle of high costs and ongoing losses.

Competitive Pressures in the Industry

Although the autonomous last-mile delivery sector is young, it has already attracted significant competition from players like Amazon (AMZN) with Scout, Alphabet’s (GOOGL) Google Wing, and various smaller entrants such as Nuro, Starship Technologies, Kiwibot, and Coco. This competition creates a fragmented market landscape.

Larger competitors like Amazon and Alphabet have substantial financial resources, enabling them to invest heavily in research and development. This advantage positions them to outperform smaller firms like Serve Robotics, which may face ongoing uncertainty.

For example, Amazon benefits from a robust logistics network, while Google Wing leverages Alphabet’s advanced AI and mapping technologies—areas where SERV needs to improve. Furthermore, larger firms are better equipped to handle the regulatory challenges likely to arise with the increasing presence of robots in public spaces.

Concerns Over SERV’s Valuation

Currently, SERV stock is considered overvalued, as indicated by a Value Score of F. Despite its recent stock price decrease, SERV continues to trade at a premium forward 12-month price-to-earnings (P/S) ratio compared to industry peers.

Synopsys Forward 12-Month P/S Ratio

Image Source: Zacks Investment Research

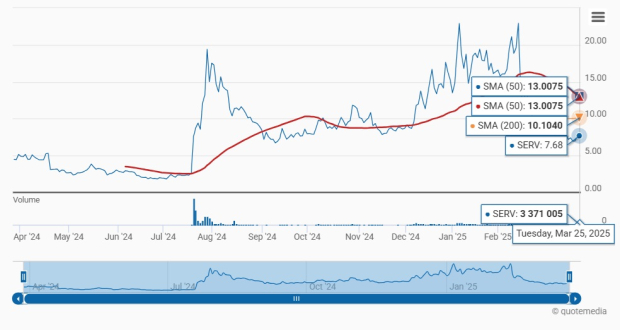

Technical Indicators Signal Bearish Trends for SERV

Technical analysis suggests that SERV may face more downside. The stock has been trading below its 50-day and 200-day moving averages—key thresholds that traders often monitor to assess short-term momentum. The combination of elevated valuation and poor technical indicators points to possible volatility ahead for Serve Robotics.

50-Day and 200-Day Moving Averages Indicate Bearish Trend

Image Source: Zacks Investment Research

Conclusion: Consider Exiting SERV Stock

Serve Robotics faces numerous challenges, including macroeconomic pressures and competition from larger firms that restrict its growth. The company’s customer concentration risk further adds to its instability.

With rising tariffs affecting its key restaurant customer base and disappointing quarterly results, investor sentiment remains precarious.

Given these complexities, it is advisable for investors to avoid this Zacks Rank #4 (Sell) stock for the time being. For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Zacks Highlights Top Semiconductor Stock

Our top chip stock is significantly smaller than NVIDIA, which has soared over +800% since our recommendation. NVIDIA remains competitive, but our new pick has better scalability potential.

With robust earnings growth and an expanding customer base, it’s well-positioned to meet the soaring demand in Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days. Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report.

Technology Select Sector SPDR ETF (XLK): ETF Research Reports.

Alphabet Inc. (GOOGL): Free Stock Analysis report.

Serve Robotics Inc. (SERV): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.