Skechers Faces Significant Decline Amid Tariff Challenges in 2025

Skechers U.S.A., Inc. (SKX) experienced a nearly 30% drop in 2025.

The decline follows a negative earnings outlook, which worsened after Skechers’ Q1 earnings report on April 24. The company withdrew its annual financial guidance for the year due to ongoing tariff issues.

Current Situation at Skechers

Skechers U.S.A. designs, develops, and markets a diverse range of lifestyle and performance footwear for men, women, and children, as well as apparel and accessories. The company has enjoyed substantial growth by targeting a different consumer base compared to giants like Nike.

Recognized for its comfortable shoes, Skechers has also expanded into performance footwear, which includes soccer cleats supported by professional athletes.

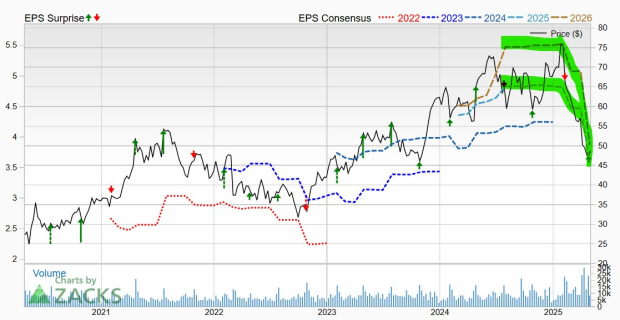

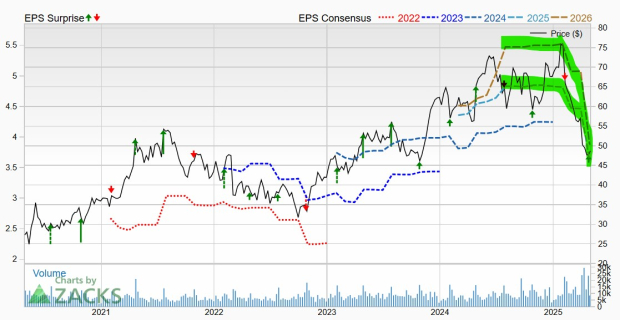

Image Source: Zacks Investment Research

Despite its previous impressive growth, including a 7.1% increase in Q1 2025 revenue, Skechers has been significantly impacted by trade tensions. The company has opted not to provide new financial forecasts, citing “macroeconomic uncertainty related to global trade policies.”

Image Source: Zacks Investment Research

Following these developments, analysts have significantly downgraded their expectations. The consensus EPS estimate for FY25 has fallen to $3.61 from $4.42 within just a week. Additionally, the 2026 estimate has decreased by 23% since the Q1 report.

Should Investors Avoid SKX Stock?

The recent downward revisions in earnings have led to further declines in Skechers’ stock, resulting in a Zacks Rank #5 (Strong Sell).

While Skechers continues to forecast 7% sales growth for 2025 and 2026, these projections are subject to change as market conditions evolve.

Currently, SKX stock trades below its 200-week moving average and demonstrates historically oversold Relative Strength Index (RSI) levels. However, attempting to time the bottom for Skechers carries inherent risks due to ongoing uncertainties in trade policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.