“`html

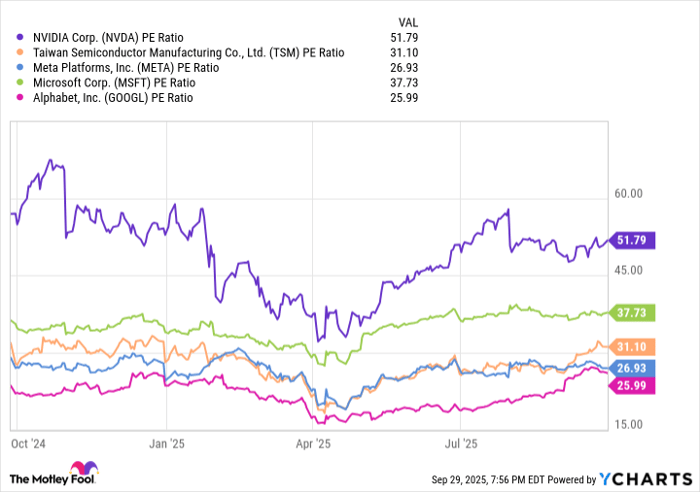

The S&P 500 has surged by 73% since the start of 2023, driven largely by the gains of major tech firms such as Nvidia, Meta, and Microsoft amidst an AI-driven growth trend. The index currently has a price-to-earnings ratio of 28, indicating a potentially inflated market.

A notable bubble appears to be forming in certain sectors, particularly zero-revenue emerging technology stocks. For example, modular nuclear reactor company Oklo has seen its stock price skyrocket 1,200% in the past year despite having no revenue and no expectations to generate any until 2027, giving it a market cap of nearly $17 billion. Similarly, the market cap for electric vertical takeoff and landing company Archer Aviation is $6 billion, also without any revenue.

Investor enthusiasm for AI stocks has carried over into these unproven sectors, echoing past stock market bubbles. Companies like Oklo and Archer Aviation face significant risks, as their current valuations may not accurately reflect their ability to generate revenue in the near future.

“`