Market Turmoil: Understanding 2023’s Early Financial Performance

This year has been filled with confusion and discomfort for many watching the stock market. Practically since January, the financial landscape has experienced unprecedented volatility.

2023’s Market Challenges

Several significant events have shaped the current market climate:

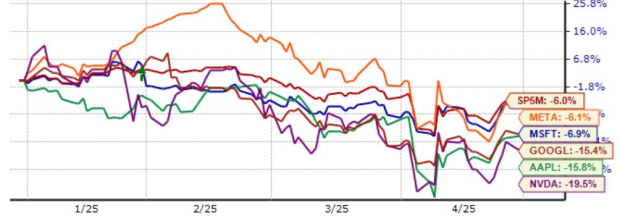

- S&P 500 Correction: A 10% correction occurred within 20 trading days, between February and March.

- Rapid Decline: In early April, the market saw a rapid 10% drop over just two days—a rare event that has only occurred five times in the last century during crises such as the Great Depression and the 2008 recession.

- Major Rally: On April 10, the Dow Jones Industrial Average surged 7.9%, its most significant single-day gain since March 2020. Similarly, the S&P 500 increased by 9.5%, while the Nasdaq jumped 12.2%, marking its second-best day ever.

- Earnings Season Decline: The first-quarter earnings season began with a slump, as all major indices closed in negative territory.

- Recent Upward Movement: After a four-day upward trend, notable gains were observed: the Nasdaq rose by 6.7%, S&P 4.6%, and Dow 2.5%, triggering rare bullish technical buy signals.

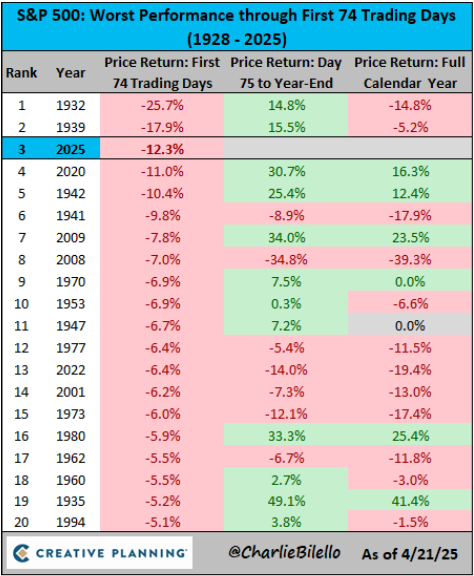

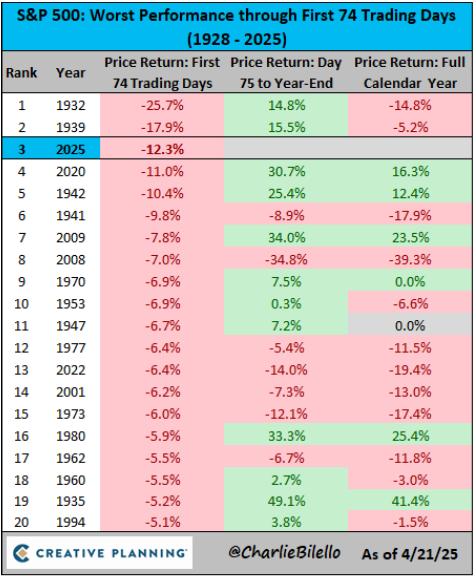

Despite these recent gains, the market had been tracking toward its third-worst year on record, down over 12% in the first 74 trading days. The only years with worse starts were 1932 and 1939, periods during the Great Depression.

This year’s situation has undeniably become severe.

Understanding the Underlying Causes of Market Volatility

Much of this turmoil has been linked to what some are calling “Liberation Day.”

This term refers to the day President Trump initiated aggressive tariffs on nearly every U.S. trading partner, igniting a turbulent trade war. The goal was to reshape American trade, but the immediate impact led to a drop in consumer confidence and a spike in Treasury yields, resulting in widespread panic across Wall Street.

The ensuing chaos included:

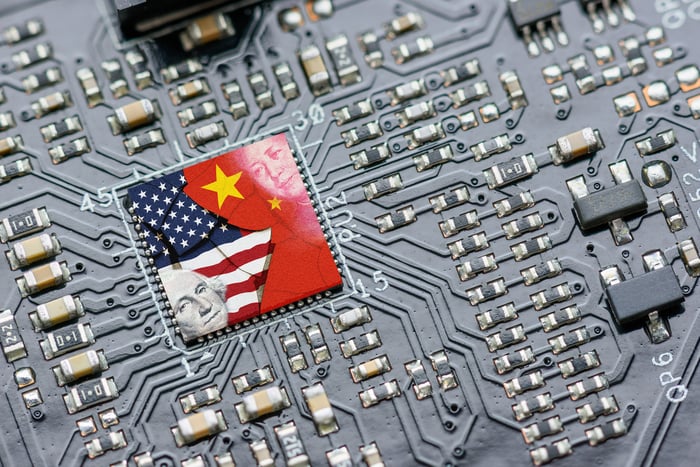

- China’s Retaliation: China introduced tariffs on 128 American products, including significant tariffs on aluminum, cars, and pork.

- Increased U.S. Tariffs: President Trump further hiked tariffs on China up to 125%.

- Temporary Tariff Pauses: The U.S. paused tariffs on some trading partners but continued escalating tariffs on China.

- Exemptions Announced: Electronics were exempted from some tariffs, with discussions about possibly excluding auto parts.

- Lack of Tangible Progress: Despite claims of productive talks with trading partners, no significant trade deals have been finalized.

- Potential New Tariffs: New probes may lead to tariffs on semiconductors and pharmaceuticals.

The situation resembles a political drama rather than a stable market environment. Investors from large hedge funds to everyday individuals are increasingly uncertain about what lies ahead.

Preparing for Future Market Shocks

Looking ahead, significant developments are anticipated soon. On Wednesday, May 7, new actions from Washington could potentially trigger a $7 trillion panic in global markets.

This emerging situation is projected to be more impactful than current tariffs, affecting various sectors including stocks, bonds, commodities, and cryptocurrencies.

For those feeling overwhelmed by the current market instability, more turbulence may be on the horizon.

To address these concerns, a special market briefing is scheduled for Thursday at 7 PM ET. This session promises to outline anticipated challenges and strategies for investors to safeguard their portfolios.

As of publication, Luke Lango held no positions in the mentioned securities.

If you have questions or feedback about this analysis, please reach out at [email protected].