Market Sells Off Ahead of Thanksgiving as Investors Take Profits

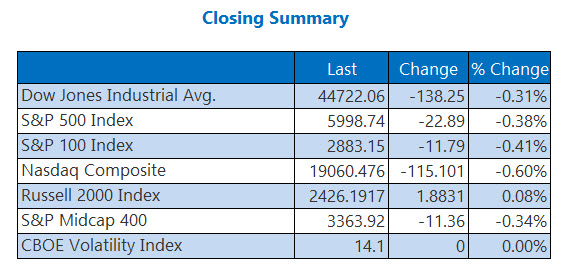

On the eve of Thanksgiving, stocks experienced a decline. Traders capitalized on gains from technology stocks following the latest PCE report, which showed a monthly and annual increase. The Dow and Nasdaq both suffered triple-digit losses, with the Dow ending a five-day losing streak. In contrast, the S&P 500 dropped for the first time in seven days. Markets will reopen on Black Friday with an early closing time of 1 p.m. ET.

Discover more insights into today’s market trends:

Key Market Developments

- Mortgage applications surged by 12% in the past week, reaching a 52% increase year-over-year. (CNBC)

- A formal ceasefire has been reached between Israel and Hezbollah, though recovery efforts will take time. (Reuters)

- Ambarella stock climbed to 12-month highs after a positive earnings report.

- A meaningful driver led to a rise in Urban Outfitters stock.

- Pessimistic outlooks weighed down two software stocks.

Oil Market Adjustments

Oil futures bounced around before closing slightly lower. The ceasefire in the Middle East drew attention to the Organization of the Petroleum Exporting Countries and its allies (OPEC+). Additionally, U.S. inventory reports indicated a smaller-than-expected decrease in crude oil stocks. For the session, January-dated West Texas Intermediate (WTI) crude fell 5 cents, settling at $68.72 per barrel.

Moreover, today’s inflation data contributed to a rebound in gold prices. December gold futures rose by 0.7% to approximately $2,644.00 an ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.