The stock market has been sizzling. The S&P 500 has surged past 5,000 for the first time, the Dow Jones Industrial Average frequently notches new all-time highs, and the Nasdaq Composite is riding the wave of artificial intelligence (AI) optimism, boasting a 33% gain over the past year.

As stock prices soar to unprecedented heights, the concept of stock splits gains traction. Three prominent players in the AI arena – Super Micro Computer (NASDAQ: SMCI), Nvidia (NASDAQ: NVDA), and Meta Platforms (NASDAQ: META) – are poised for potential stock splits.

Image source: Getty Images.

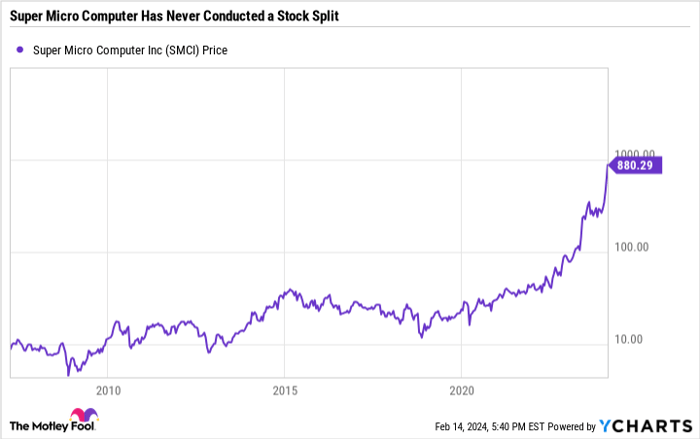

The Hottest AI Stock Around Looks Primed for a First-Ever Split

Jake Lerch (Super Micro Computer): With a remarkable 774% total return in the last 12 months, Super Micro Computer has been a standout in this bull market. The stock has skyrocketed from around $86 to over $880 per share, indicating a pressing need for a stock split. Despite never having conducted a stock split in its 17 years on the public market, the company’s surging stock price, approaching $900, combined with heightened investor interest, signals that the time might be ripe for a split.

Moreover, Super Micro Computer’s near-term outlook is highly promising, fueled by the AI revolution’s impact on demand for its off-the-shelf server racks – crucial components for AI data centers. Exceptional earnings results, an upward revision of full-year guidance, and optimistic commentary in a recent post-earnings conference call further augment the company’s outlook.

SMCI data by YCharts

AI Chip Dominance Has Taken this Stock’s Share Price into the Clouds

Will Healy (Nvidia): Fueled by the generative AI boom, Nvidia has experienced a nearly 240% surge in its stock over the past year. With its share price hovering around $740, its market leadership and growth trajectory make a compelling case for another split. Boasting an estimated 85% market share in the high-end AI chip segment and favorable projections of a 38% compound annual growth rate for the AI chip sector through 2032, Nvidia’s stellar performance is exemplified by a 206% year-on-year revenue increase to over $18 billion for the third quarter of fiscal 2024. This surge in revenue has been accompanied by a substantial rise in gross margin and net income, underscoring the company’s remarkable growth potential.

Furthermore, apart from its financial prowess, Nvidia’s potential addition to the Dow Jones Industrial Index, owing to its significant market cap of $1.8 trillion, complements the case for a split. This move would not only enhance its prestige but also pique investor interest, acting as an additional positive catalyst.

A Stock Split Could Potentially Keep Meta’s Red-Hot Momentum Going

Justin Pope (Meta Platforms): From a low of $89 in late 2022, Meta Platforms has surged towards the $500 mark, reflecting a resounding resurgence driven by successful maneuvers to revitalize its advertising business and streamline expenses. Amidst the stock’s ups and downs, two consistent and reassuring trends have emerged: sustained growth in Meta’s three flagship social media apps – Facebook, Instagram, and WhatsApp – and concerted investments in AI infrastructure to fuel its long-term ambitions. Leveraging AI in its advertising business and the ample scope for innovation in its user-facing apps, Meta has demonstrated a robust foundation for long-term growth.

META data by YCharts

While a stock split in itself does not alter a company’s fundamental valuation, Meta’s attractive forward P/E ratio of 23, considering the expected 20% annualized earnings growth, positions it as a compelling choice for long-term investment post-split.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Nvidia. Justin Pope has no position in any of the stocks mentioned. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Super Micro Computer and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.