Over the past year, the stock market has witnessed a surge in the value of technology stocks, driven by the fervor surrounding artificial intelligence (AI). One such tech titan, Microsoft (NASDAQ: MSFT), has seen its share price soar to over $400, posing a challenge for individual investors looking to add the stock to their portfolios. Seemingly out of reach, these lofty valuations naturally raise the question—could a stock split be on the horizon?

Stock splits—dividing existing shares into multiple shares—are a common corporate maneuver that can potentially benefit both investors and employees. However, there are crucial dos and don’ts for investors to consider in the event of a stock split. Let’s explore why Microsoft might entertain the idea of a split and what actions investors should take if such an event takes place.

Microsoft’s Stock-Split History: Here’s the Scoop

Stock splits are not just number games; they can yield substantial advantages for both investors and employees. For investors, a towering share price renders it challenging to acquire whole shares, while many companies compensate employees with stock, making it cumbersome for them to manage their stock holdings. Splitting the stock reduces the share price, thereby alleviating this dilemma for both buyers and sellers.

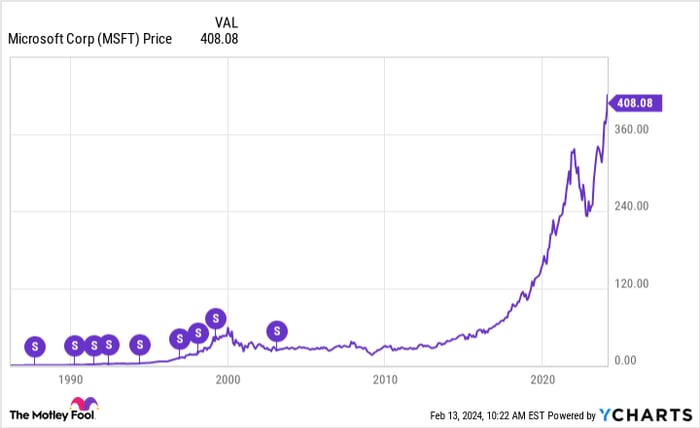

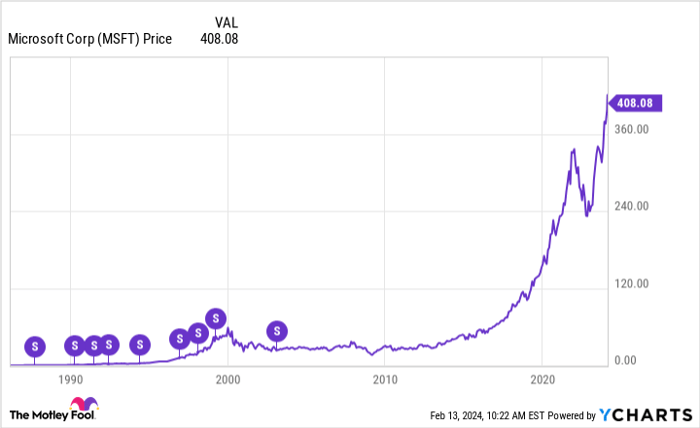

While Microsoft has undergone multiple stock splits in the past, all of these actions occurred several years ago. The company executed nine splits from the late 1980s to the early 2000s but has not ventured down this path since. As illustrated in the chart below, the share price has soared exponentially over recent years:

MSFT data by YCharts

While the company ushered in the era of cloud computing with Azure in 2010, 2023 is potentially the dawn of Microsoft’s AI golden age. A stock split would serve as a strategic move for investors and employees to position themselves in anticipation of a promising future.

The Crucial Insight To Remember About Stock Splits

An often overlooked caveat with stock splits is the misconstrued association of a lower share price with a reduced valuation. It is imperative to comprehend that price and valuation are not interchangeable. Essentially, investors pay a particular price for a share of the company’s profits. While a stock split divides the company into more shares, each share represents a smaller portion of the company’s earnings.

For instance, analysts project that Microsoft will generate $11.60 per share in the current fiscal year ending in June. Supposing Microsoft declares a 10-for-1 split—meaning one share of stock will transform into 10 smaller shares—priced at $40 each for a $400 stock, the company’s earnings would also be split 10 ways, resulting in earnings per share of $1.16. In this scenario, the stock’s P/E ratio would remain constant, aligning with the principle that the value remains unchanged pre and post-split.

Considering Investing in Microsoft? This is a Must-Read

Remember, the decision to invest in a stock should not hinge on the potential for a stock split, as it has no bearing on the actual value proposition. Instead, it is essential to evaluate Microsoft’s valuation relative to its growth prospects.

Presently, Microsoft’s P/E ratio hovers around 35, with analysts anticipating a long-term annual earnings growth of 15%. This yields a PEG ratio of 2.3, indicating that Microsoft may be slightly overpriced relative to its growth potential (a PEG ratio of 1 signifies a fair value). The dynamics of growth may far exceed or fall short of expectations, with the narrative possibly evolving differently in hindsight. Maintaining a long-term perspective is advantageous, affording Microsoft the time to align with its stock’s valuation and beyond.

Whether or not to invest in Microsoft, it is crucial to base the decision on fundamental analysis rather than the possibility of a stock split.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Microsoft made the list—but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.