A New Era of Accessibility

Recent years have ushered in a wave of stock splits as companies strive to enhance share liquidity and eliminate barriers to investor entry. Lower share prices now cater to a broader swath of investors, even as the advent of fractional share investing addresses accessibility concerns for some.

Remember, stock splits are mere facelifts that leave a company’s value and financial health untouched.

Going Big: Walmart’s Move

Behemoth Walmart has entered the fray by executing a 3-for-1 split, marking its first split since 1999. The retail titan is riding high after a robust FY24, boasting a 6% year-over-year revenue surge and a staggering 32% spike in operating income to $27.0 billion compared to FY23. With its competitive pricing, Walmart has snared increased market share in groceries and general merchandise among affluent households, capitalizing on ongoing eCommerce momentum.

The company’s unwavering revenue growth is a testament to its enduring performance over the years.

Image Source: Zacks Investment Research

This split was tailored to make shares more accessible to Walmart’s workforce and investors, with over 400k Walmart associates partaking in the Associate Stock Purchase Plan.

Life After Split: Case Studies

With Walmart stocks now within reach, the burning question emerges – is it wise to dive in post-split? Let’s look at post-split performances from Novo Nordisk NVO and Celsius Holdings CELH.

Last September, Novo Nordisk executed a 2-for-1 split, yielding approximately 29% gains post-split. Subsequent to its latest quarterly report, the company triumphed with a 7.6% earnings beat over the Zacks Consensus EPS estimate, coupled with sales surpassing expectations by 4%.

Image Source: Zacks Investment Research

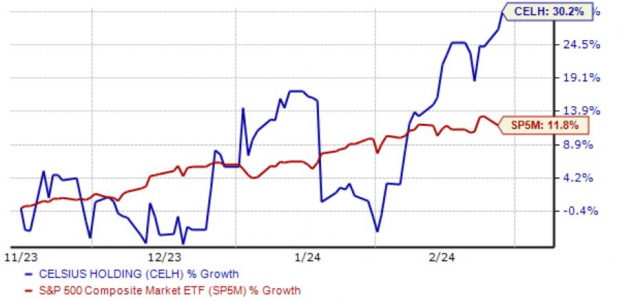

In the case of Celsius, shares have soared over 30% post-split (since November 15th), outperforming the S&P 500 by a wide margin. It’s notable that the company is gearing up to unveil its next quarterly results on February 29th, with consensus estimates projecting an eye-popping 1500% surge in earnings on a 82% revenue uptick.

Image Source: Zacks Investment Research

The Parting Shot

Goliath retailer Walmart WMT has set the stage for greater accessibility by undergoing a split, catering to both employees and investors. Stock splits generally signal a positive turn, with lowered share prices spurring enhanced liquidity.

Although Celsius CELH and Novo Nordisk NVO have dazzled with market-beating post-split returns, relying solely on post-split purchases is no panacea. Instead, focusing on optimistic earnings estimate revisions emerges as a prudent strategy to unearth stocks poised for near-term upswings.

Just Released: Zacks Top 10 Stocks for 2024

Seize the opportunity to jump on board our top 10 stock picks for 2024. Curated by Zacks Director of Research, Sheraz Mian, this portfolio has consistently outperformed. From inception in 2012 through November 2023, the Zacks Top 10 Stocks soared +974.1%, nearly tripling the S&P 500’s +340.1%. With a meticulous selection process from 4,400 Zacks Rank-covered companies, Sheraz unveils the cream of the crop poised for astronomical growth in 2024. Be among the first to explore these potential gems.

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

To delve deeper into this article on Zacks.com, click here.

The viewpoints and expressions presented herein are those of the author and do not necessarily mirror Nasdaq, Inc.’s perspectives.