Downtown Dilemma: AMN Healthcare Faces Growing Financial Challenges

AMN Healthcare Services, Inc. continues to struggle in the healthcare staffing market. This Zacks Rank #5 (Strong Sell) predicts earnings to plummet by 62.4% this year, with no recovery in sight for 2025.

AMN Healthcare offers comprehensive talent solutions for healthcare organizations in the United States. Their services encompass direct staffing, managed services programs, clinical leadership, temporary staffing, permanent placement, recruitment process outsourcing, and more.

Their diverse clientele includes acute-care hospitals, community health centers, physician practice groups, retail and urgent care centers, home health facilities, and educational institutions.

AMN Healthcare Surprises Again in Q3 2024

On November 7, 2024, AMN Healthcare Services announced its third quarter results for 2024, surpassing the Zacks Consensus Estimate by $0.03. Their earnings reached $0.61 compared to the expected $0.58.

This achievement is noteworthy, as AMN has maintained a flawless five-year track record of exceeding earnings expectations. Few companies have emerged unscathed from the COVID pandemic, especially those tightly linked to healthcare staffing.

However, despite the earnings beat, the company has yet to discover a recovery point amid ongoing post-COVID corrections. Demand for healthcare professionals, especially nurses, peaked during the pandemic but current industry conditions remain difficult.

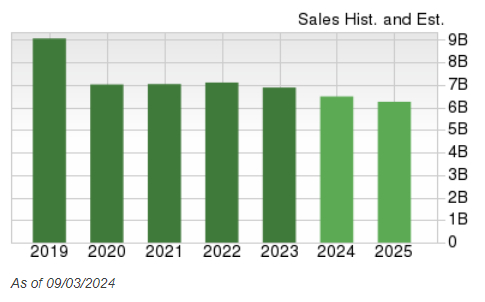

The company’s revenue dropped by 19% to $687.5 million, which is down 7% compared to the previous quarter, although they consider this to be better than expected.

A significant decline happened in the Nurse and Allied Solutions segment, which fell by 30% year-over-year to $399 million, marking a 10% decrease from the prior quarter.

Travel nurse staffing, a service that flourished amid the pandemic, saw a staggering drop of 37% year-over-year and a 12% decline sequentially. Additionally, revenue from the allied division decreased by 16% year-over-year.

As of September 30, 2024, AMN Healthcare held $31 million in cash and cash equivalents, while total debt stood at $1.135 billion.

Analysts Lower AMN Healthcare’s Earnings Projections

Unpromising fourth-quarter guidance suggests that a bottom may not be approaching anytime soon.

Analysts are taking a cautious stance, with three revising their estimates for 2024 and four making cuts for 2025 over the past month.

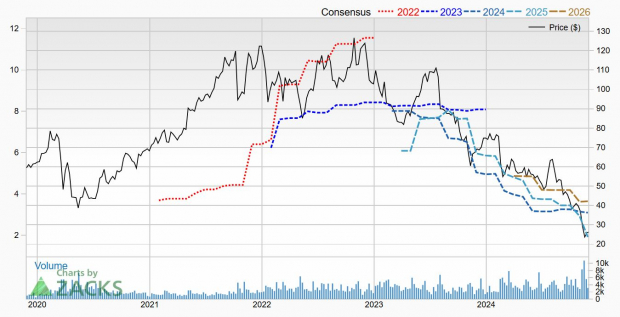

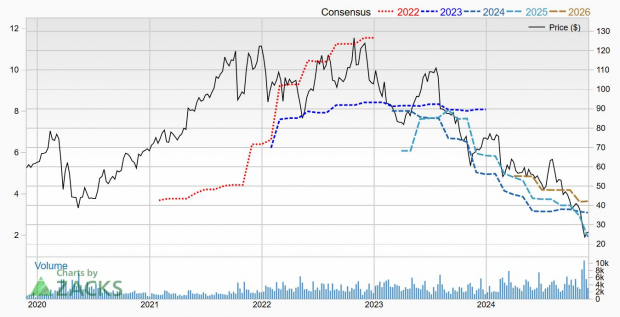

The Zacks Consensus Estimate for 2024 has decreased to $3.09 from $3.15, a 62.4% drop from the $8.21 earned last year. The outlook for 2025 is similarly bleak, with the consensus falling to $1.92 from $2.93, reflecting a further decline of 38.1%.

The implications of these estimates can be seen in the price and consensus chart below:

Image Source: Zacks Investment Research

AMN Healthcare Services at 5-Year Lows: An Investing Puzzle?

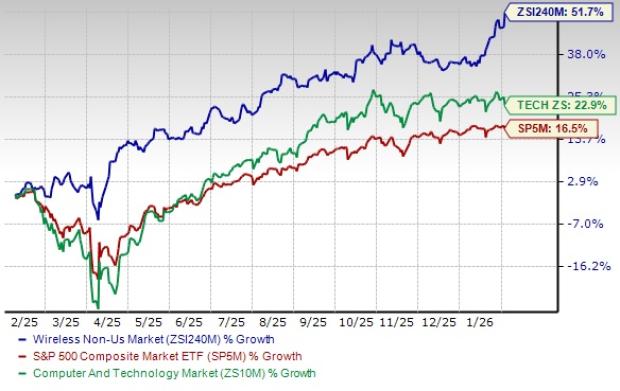

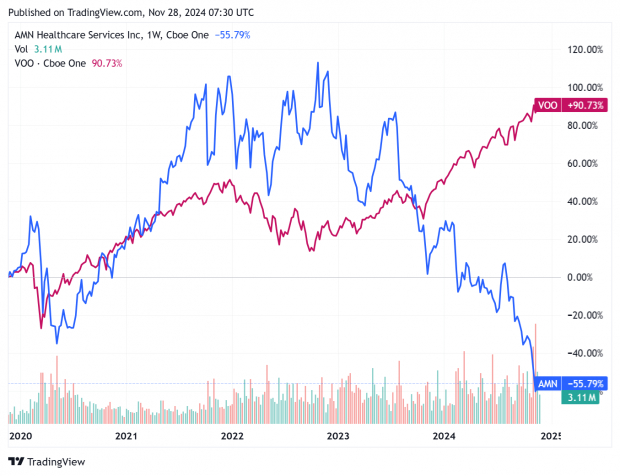

AMN Healthcare Services experienced a surge in stock value during the pandemic, reaching record revenue highs. However, their shares have fallen significantly in recent years, now hitting a new five-year low.

Image Source: Zacks Investment Research

Stocks are down 66% for the year, raising questions about their current valuation. Although AMN Healthcare appears inexpensive with a forward price-to-earnings (P/E) ratio of 8.5, continued reductions in earnings estimates suggest it may be more of a trap than a true opportunity.

Potential investors focused on staffing companies may find it prudent to remain on the sidelines for now.

Invest Today: Unlocking the Potential of Nuclear Energy

The demand for electricity is surging, alongside efforts to minimize reliance on fossil fuels like oil and natural gas. Nuclear energy presents a promising alternative.

Recently, leaders from the U.S. and 21 other nations pledged to triple global nuclear energy capacities. This ambitious move could create significant opportunities for investors targeting nuclear-related stocks if they act quickly.

Our latest report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into key players and technologies poised to take advantage of this trend, spotlighting three standout stocks likely to benefit the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.