AppLovin: An AI Powerhouse with 85% Upside Potential

https://www.youtube.com/watch?v=PT1uikdixBM[/embed>

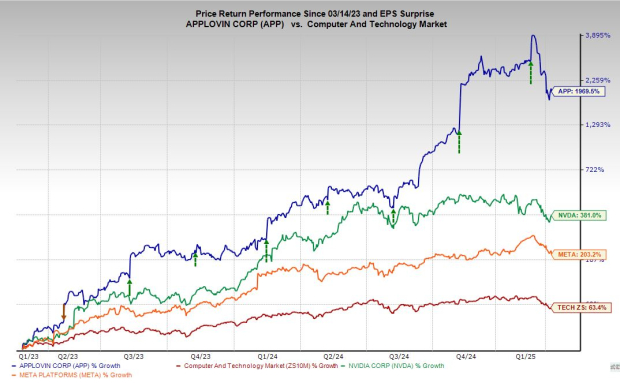

AppLovin Corporation APP is a leading player in AI-driven app monetization, having soared 2,000% over the last two years, compared to Nvidia’s (NVDA) 400% increase. Currently, investors can acquire APP stock at almost 50% below its peak and 85% below its average Zacks price target.

Market Corrections Offer Attractive Buying Opportunities

The recent selloff in AppLovin’s stock was a natural correction after a period of rapid growth, often seen when a stock becomes overheated. While APP and the broader AI sector might experience further volatility in the near term, this presents long-term investors an opportunity to purchase quality stocks at significant discounts.

Acquiring AppLovin now, when prices are down 50% from previous highs, becomes appealing due to the company’s strong earnings and revenue growth projections driven by AI technology.

Wall Street analysts maintain a positive outlook on APP, noting that the stock is finding support near essential technical levels while trading at more favorable valuations.

What Makes AppLovin a Wall Street Favorite?

As smartphone usage continues to rise globally, AppLovin is dedicated to helping app developers grow their businesses. The company offers a robust range of tools designed to assist clients in navigating the competitive app ecosystem.

Their technology supports clients in mobile gaming and other sectors by enhancing user acquisition, improving engagement, and maximizing the lifetime value of customers. AppLovin connects clients with diverse audiences including in-app users, mobile subscribers, and CTV viewers.

Image Source: Zacks Investment Research

In 2021, AppLovin experienced a remarkable 93% sales increase. However, growth slowed to just 1% in 2022, coinciding with a slump in the digital advertising sector that impacted major players like Meta META.

Recently, the nearly $800 billion digital ad market has rebounded, allowing AppLovin to leverage its advanced AI capabilities. Their AI-powered solutions have led to significant revenue and earnings growth, attracting clients eager to improve their marketing outcomes.

Image Source: Zacks Investment Research

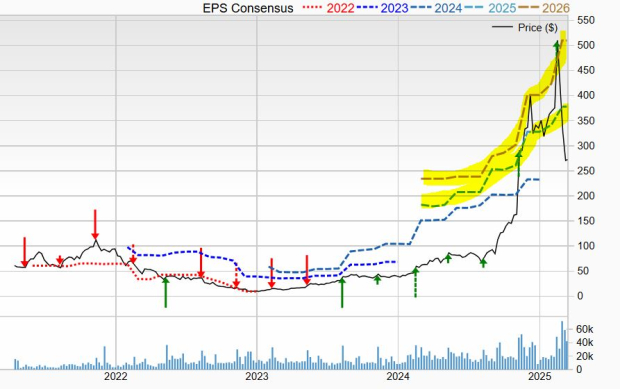

In Q2 2023, AppLovin launched its AXON technology, driven by advanced machine learning and AI. This innovation marked a turning point, as the company reported a 17% increase in revenue and transitioned from a loss of -$0.52 per share to a profit of +$0.98. Projections for 2024 indicate expected sales growth of 43% and an impressive 362% increase in earnings.

Anticipated Growth in AppLovin’s Future

On February 12, AppLovin beat Q4 EPS estimates by 29%, and its strong guidance significantly boosted the FY26 earnings outlook. CEO Adam Foroughi expressed a commitment to efficiency through automation, emphasizing a drive to create a lean organization even amid expansion.

Image Source: Zacks Investment Research

As it looks forward to 2025, APP plans to focus on five key growth pillars, one of which aims to leverage AI for personalized ad experiences. This change would allow AppLovin to deliver dynamic, customized ads, contrasting sharply with static, traditional advertising formats.

In addition, AppLovin intends to broaden its market presence, aspiring to serve as a comprehensive advertising platform for industries such as gaming and direct-to-consumer businesses.

With a commitment to automation and personalization, APP is expected to achieve 20% revenue growth in both 2025 and 2026, increasing from $4.71 billion in FY24 to $6.78 billion in FY26.

Image Source: Zacks Investment Research

In terms of earnings, AppLovin is projected to grow by 52% in 2025 and 37% in 2026, following an extraordinary 362% growth in 2024. This trajectory would boost EPS from $0.98 in FY23 to $9.42 in FY26.

Following the release of its Q4 results, APP’s FY26 earnings estimate surged by 25%, along with a 14% increase for FY25, giving it a Zacks Rank #1 (Strong Buy). Over the past year, the consensus EPS estimate for 2026 has jumped by 130%. Notably, AppLovin has exceeded EPS estimates by an average of 24% over the last four quarters.

Should Investors Consider AppLovin at Current Price Levels?

AppLovin’s stock skyrocketed 2,000% in the past two years following a notable dip in 2022, outperforming Nvidia’s (NVDA) 400% rise and lagging behind Meta’s (META) 225% during the same period.

Given its strong fundamentals and growth outlook, AppLovin appears to offer significant investment potential for those looking to enter the market at a favorable price point.

AppLovin’s Stock Performance Surges Amid Broader Market Trends

AppLovin’s stock has surged 300%, sharply outperforming the Tech sector’s 30% rise and Meta’s 90% gain. However, these impressive figures also reflect AppLovin’s notable decline of about 50% from its mid-February highs.

Image Source: Zacks Investment Research

Currently, AppLovin trades approximately 87% below its average price target set by Zacks, with 16 out of 21 brokerage recommendations classified as “Strong Buys.” This market optimism suggests potential for recovery.

Despite the drop from overbought RSI levels into oversold territory, AppLovin may soon approach its 200-day moving average. The company found buying interest near a gap up in November, fueled by excellent earnings and rising optimism following the Trump election.

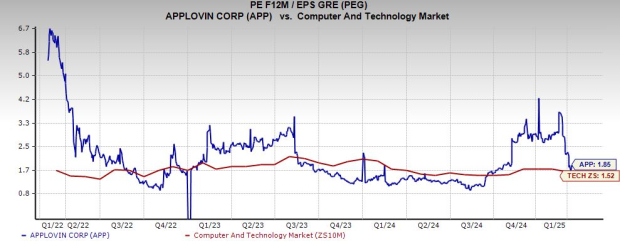

AppLovin’s current stock price remains 93% lower than its all-time highs and is 18% below its median valuation, currently priced at 36.9X forward 12-month earnings. Notably, its valuation closely aligns with the Tech sector’s Price/Earnings-to-Growth (PEG) ratio of 1.5, resting at 1.8, consistent with its historical median.

Image Source: Zacks Investment Research

Given the prevailing near-term market volatility, prudent investors might consider cautiously investing in AppLovin and similar underperforming AI stocks instead of taking a larger plunge.

The rapid and steep selloff of AppLovin, along with competitors such as Palantir, Nvidia, and Constellation Energy, provides a valuable opportunity for investors who missed earlier rallies to acquire shares at more attractive prices and valuations. Should the stock decline further, bullish investors may want to consider bolstering their positions.

Zacks’ Research Chief Identifies Top Stock with Doubling Potential

Our team has recently identified five stocks that show the highest potential for a +100% gain in the upcoming months. Among these, Director of Research Sheraz Mian highlights one stock as particularly promising.

This standout is recognized as one of the most innovative financial companies, boasting a rapidly expanding customer base of over 50 million and a diverse array of advanced solutions. Although not every elite pick guarantees success, this stock could achieve significant growth, possibly exceeding previous Zacks high-flyers like Nano-X Imaging, which jumped +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days for free. Click to get this report.

NVIDIA Corporation (NVDA): Free Stock Analysis report

AppLovin Corporation (APP): Free Stock Analysis report

Meta Platforms, Inc. (META): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.