“`html

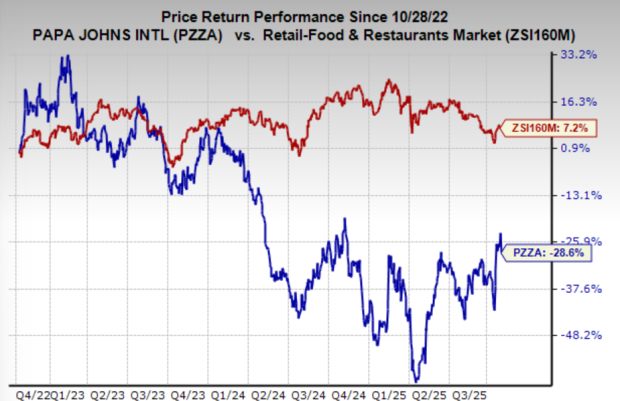

Papa John’s International (PZZA) has experienced ongoing challenges, including sluggish sales growth and issues related to its former CEO, leading to a significant decline in stock performance since early 2022.

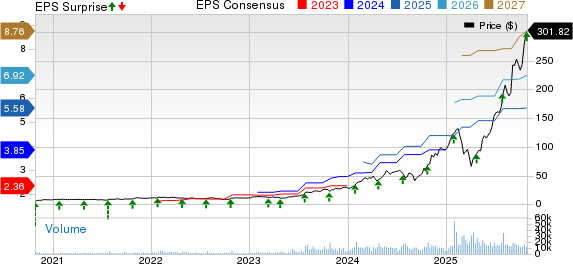

Analysts have reduced earnings estimates for the current year by 1.7% and for next year by 4.5%. Revenue growth is anticipated to be just 2.9% this year, with projections of 1.2% in 2026, amidst an overall industry ranking in the bottom 9% of Zacks’ sectors.

Papa John’s trading at a forward earnings multiple of 31.2x exceeds both the industry average and its 10-year median of 28x. Given these factors, analysts suggest that investors may want to avoid PZZA stock until performance improves.

“`