**Callaway Golf Company Achieves 52-Week High amid Strategic Moves**

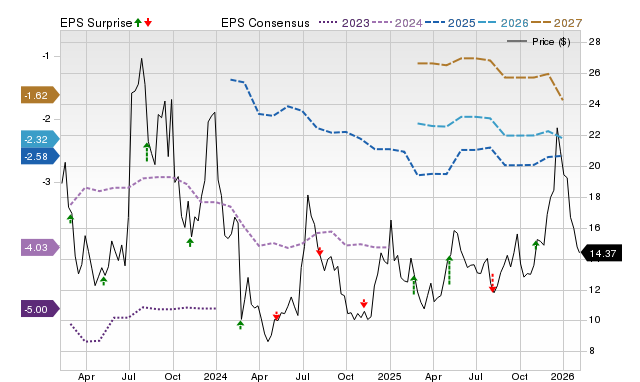

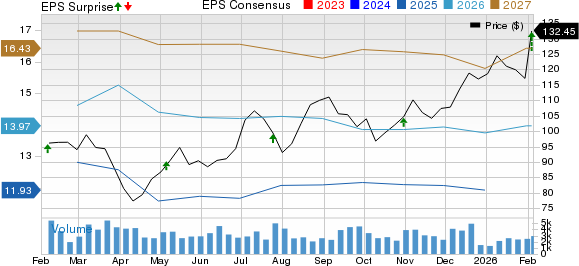

Callaway Golf Company reached a 52-week high recently, driven by increasing stock volume and buying pressure. As a leading player in the golf equipment industry, it ranks as the #1 club sales company in the U.S. and the #2 ball brand behind Titleist. Callaway’s stock surged from around $5 last year to over $15 as of January 2026, reflecting a significant growth trend.

In a strategic move, Callaway sold a 60% stake in its Topgolf and Toptracer businesses for approximately $1.1 billion, netting about $800 million after transaction costs. This equity deal not only allowed the company to pay down $1 billion in debt but also authorized a $200 million stock buyback. Analysts have raised Callaway’s fiscal 2026 earnings per share (EPS) estimate by 250% in the past 60 days, now projecting an EPS of 27 cents—a nearly 260% increase from the previous year.