Comfort Systems USA (FIX): A Strong Buy Amidst Growth in AI Infrastructure

Comfort Systems USA (FIX) specializes in comprehensive heating, ventilation, and air conditioning services. These include installation, maintenance, repair, and replacement, as well as critical components for data centers such as chillers and cooling towers.

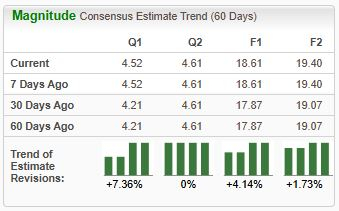

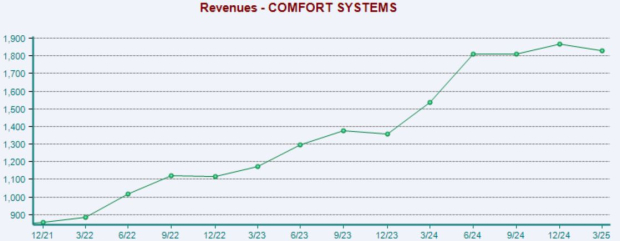

The stock currently holds a Zacks Rank #1 (Strong Buy), with analysts revising their earnings per share (EPS) estimates positively across the board in recent months.

Image Source: Zacks Investment Research

Building Products Industry Performance

FIX operates within the Zacks Building Products – Air Conditioner and Heating industry, which ranks in the top 17% of all Zacks industries. This favorable environment has contributed to positive earnings estimate revisions, highlighting how the stock currently stands against its competitors.

AI Infrastructure Opportunity

The company presents a compelling opportunity for investors interested in the AI infrastructure sector. Its products are essential for data centers, positioning FIX to benefit significantly from current and future demand trends.

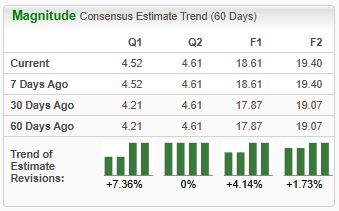

Market recognition of FIX’s potential is evident, as shares have risen by 38% over the past year, significantly outperforming the S&P 500.

Image Source: Zacks Investment Research

Strong Financial Performance

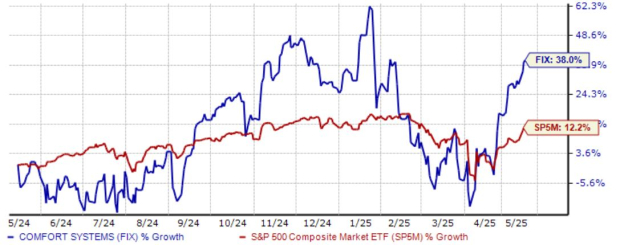

The company has consistently demonstrated robust quarterly results. In its most recent release, FIX reported sales of $1.8 billion and an adjusted EPS of $4.75, greatly exceeding consensus estimates. This performance reflects impressive growth rates of 20% for sales and 75% for EPS.

Additionally, FIX’s backlog reached a significant $6.9 billion at the end of the last period, up from $5.9 billion a year earlier, underscoring a strong demand pipeline.

Image Source: Zacks Investment Research

Dividend Insights

For income-seeking investors, FIX currently offers an annual yield of 0.3%. While the yield might seem modest, the company’s 33% five-year annualized dividend growth rate positions it well for future shareholder rewards.

Conclusion

Investors can benefit from the Zacks Rank, a tool that identifies stocks expected to outperform the market. Currently, the top 5% of stocks, ranked as Zacks Rank #1 (Strong Buy), have historically shown strong potential for growth.

Overall, Comfort Systems USA FIX presents an attractive investment opportunity marked by strong growth fundamentals and a favorable market position.