Deutsche Bank Soars Amid Positive Market Sentiment for European Stocks

As analysts increasingly favor European equities, Deutsche Bank DB has made a notable entrance onto the Zacks Rank #1 (Strong Buy) list.

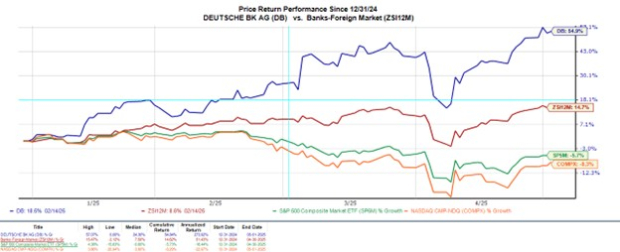

Recognized as the Bull of the Day, Deutsche Bank’s Zacks Banks-Foreign Industry currently ranks in the top 4% of over 240 Zacks industries. Deutsche Bank’s American Depository Receipt (ADR), having surged more than 50% since the beginning of 2025, stands out as the broader indices recover from recent corrections in U.S. markets.

Trading at 52-week highs of $26 per share, there appears to be further potential for Deutsche Bank stock, driven by a favorable trend in earnings estimate revisions.

Image Source: Zacks Investment Research

Improved Market Sentiment for European Equities

With a shift in sentiment around tariffs and economic uncertainties, European markets are showing resilience. Goldman Sachs GS predicts strong corporate earnings in Europe and increased defense spending as key drivers for growth. This optimistic view coincides with a significant rotation of global investors moving away from U.S. equities toward European stocks.

Furthermore, Deutsche Bank analysts have adopted a favorable outlook for other European stocks, attributed to better market conditions and lowered geopolitical tensions. Even though the European Union (EU) faces potential tariffs from Washington, analysts emphasize that major trade partners remain within Europe itself.

Deutsche Bank’s Projections

As a leading global financial institution, Deutsche Bank’s sustained expansion keeps investors interested. Being Germany’s largest bank, it anticipates total sales will rise 7% in fiscal 2025, with an additional 2% increase projected for FY26, reaching $35.39 billion.

Importantly, Deutsche Bank’s annual earnings are expected to jump 116% this year to $3.20 per share, compared to earnings per share (EPS) of $1.48 in 2024. Projections for FY26 suggest an 11% increase in EPS.

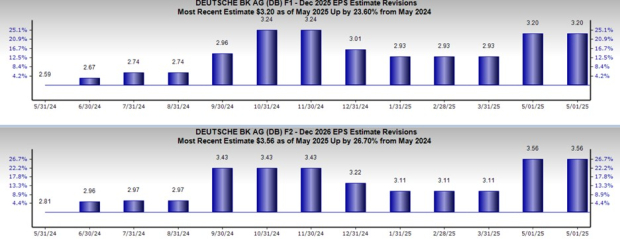

Image Source: Zacks Investment Research

Positive Earnings Revisions

The rally in Deutsche Bank’s stock is bolstered by increasing earnings estimate revisions. Recent data shows that FY25 EPS estimates (F1) have risen 9% in the last 60 days and now sit 23% above last year’s projections. Even more encouraging, FY26 EPS estimates (F2) have surged 14% over the past two months, a notable 26% increase compared to a year ago.

Image Source: Zacks Investment Research

Conclusion and Final Thoughts

Deutsche Bank earning the title Bull of the Day does not suggest that investors should avoid U.S. equities. However, the potential for continued growth in DB is not surprising, especially as it trades at 8X forward earnings and less than 1X sales.

Moreover, diversification remains a smart strategy amidst economic uncertainty, making Deutsche Bank a potential consideration alongside more prominent U.S. banking stocks.

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.