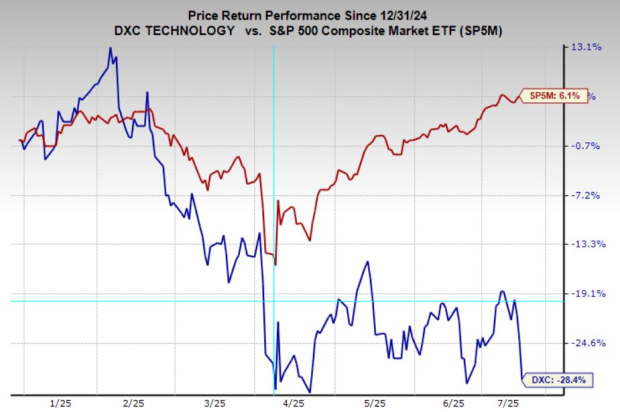

DXC Technology (DXC) is experiencing significant financial challenges, with its stock price dropping nearly 30% year-to-date and more than 65% since 2021. The company’s revenue has plunged from approximately $22 billion in 2018 to around $12.8 billion in the trailing twelve months—a decline of nearly 42%. Analysts predict further revenue decreases of 4.5% for the current fiscal year and 2.8% next year, based on ongoing struggles with demand for its core services.

Currently, DXC’s stock is facing technical weakness and selling pressure, closing at a critical support level of about $14.20. Failure to maintain this level could lead to a technical breakdown, potentially pushing the stock to new multi-year lows. As a result of its weakening fundamentals and negative analyst sentiment, investors are advised to approach DXC cautiously until clear signs of revenue stabilization materialize.