Five Below Faces Tariff Pressures Amid Earnings Growth and Stock Decline

Five Below, Inc. (FIVE) is grappling with tariff uncertainties, resulting in a Zacks Rank #5 (Strong Sell) as it guides below consensus for fiscal 2025.

As a value retailer, Five Below offers trendy, high-quality products aimed at teens and pre-teens, with most items priced between $1 and $5, while some extreme value items exceed $5.

Established in Philadelphia, Five Below operates over 1,700 stores across 44 states.

Four Consecutive Earnings Surprises: Q4 Fiscal 2024 Results

Five Below revealed its fiscal 2024 fourth quarter and full year results on March 19, 2025. The company surpassed the Zacks Consensus Estimate, reporting earnings of $3.48 compared to the consensus of $3.38. This marked the second consecutive quarter of earnings beats.

Net sales increased by 4% to $1.39 billion, up from $1.34 billion a year prior. When accounting for the impact of the 53rd week in fiscal 2023, the growth was a substantial 7.8%.

However, comparable sales—a crucial indicator for retailers—declined by 3%.

Expansion remains a focal point for Five Below, with 22 new stores opened during the quarter, bringing the total to 1,771 stores. This represents a growth of 14.7% compared to the same quarter last year.

Throughout fiscal 2024, Five Below accelerated its growth trajectory, launching 227 net new stores, up from 204 in fiscal 2023.

Fiscal 2025 Guidance: Lowered Expectations Amid Tariff Costs

In providing its guidance, Five Below considered the potential impact of tariffs. However, this assessment was made prior to Liberation Day on March 19, 2025. Analysts have yet to revise their estimates in light of post-Liberation Day developments.

The company expects comparable sales to range from flat to a 3% increase for the full year. Earnings guidance falls between $4.10 and $4.72, which is below the Zacks Consensus.

In response to the lower guidance, analysts adjusted their estimates accordingly, with nine estimates cut in the past 60 days and two revised downward in the last 30 days.

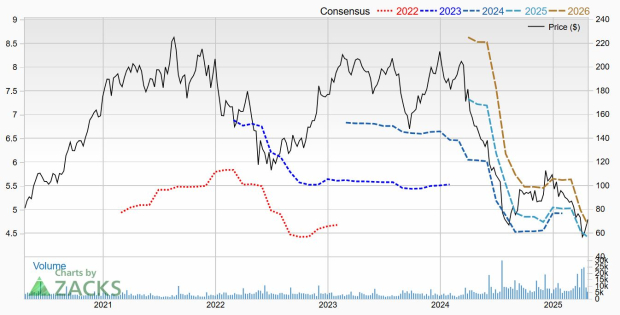

The Zacks Consensus estimate dropped to $4.44 from $5.03 just two months earlier, reflecting an 11.9% decline in earnings expectations since Five Below posted earnings of $5.04 in fiscal 2024.

Stock Performance Takes a Hit in 2025

Five Below shares have suffered significantly due to tariff uncertainties, plummeting 32% year-to-date and recently hitting new five-year lows.

Is Five Below undervalued?

The company currently trades at a forward price-to-earnings (P/E) ratio of just 15.3, placing it within value stock territory.

Furthermore, its PEG ratio, which measures earnings against growth, stands at 0.6. A ratio below 1.0 typically indicates a firm with both growth potential and value considerations.

Despite incorporating anticipated tariff impacts into its guidance in March, uncertainties about earnings for the current year linger. Five Below’s first quarter earnings report is not expected until June.

Investors may want to remain cautious and hold off on major moves until there’s more clarity on tariffs and overall business conditions.

Discover the 7 Best Stocks for the Upcoming 30 Days

Recently released: Experts have identified 7 elite stocks from Zacks Rank #1 Strong Buys, considered “Most Likely for Early Price Pops.”

Since 1988, this full list has outperformed the market more than two times, achieving an average annual gain of +23.9%. Investors should pay attention to these selected 7 stocks immediately.

Five Below, Inc. (FIVE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.