Foot Locker Faces Downturn in Sales and Earnings

Foot Locker (FL) has been grappling with major challenges in recent years, mirroring struggles across the retail sector. As a prominent retailer in footwear and apparel, the company is seeing declines in sales and shifting consumer habits, which have negatively impacted its financial performance and stock value, raising concerns for investors.

Foot Locker’s Dwindling Sales Impact Stock Performance

Foot Locker’s revenue has been on a downward trajectory, with annual sales decreasing from $8.9 billion three years ago to $8.1 billion recently. This trend highlights the challenges in achieving growth in a retail market increasingly favoring e-commerce and direct sales strategies by leading footwear brands.

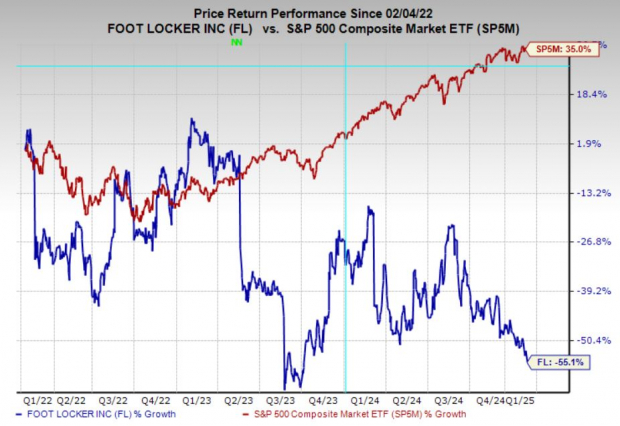

Consequently, Foot Locker’s stock has underperformed, sinking 64% in the past decade and 55% over the last three years. These declines indicate growing fears among investors regarding the company’s ability to adapt and thrive amid the shifting retail environment.

Image Source: Zacks Investment Research

Foot Locker’s Earnings Estimates Decline

Currently, Foot Locker holds a Zacks Rank #5 (Strong Sell), reflecting ongoing reductions in earnings forecasts. Analysts have persistently lowered their projections, with current quarter estimates dropping by 23.4% and those for FY25 showing a decline of 19.1%.

Image Source: Zacks Investment Research

FL Shares Trading Above Historical Averages

Despite its significant hurdles, Foot Locker’s stock is currently trading at a 16.3x forward earnings multiple, which is higher than its 10-year median of 12.1x. Given the company’s slowing sales and uncertain future, such valuation seems excessive. Typically, investors expect lower multiples for businesses facing revenue contractions and restrained growth, putting FL’s current pricing into question.

Image Source: Zacks Investment Research

Is Foot Locker a Risky Investment?

Considering its declining sales, weak stock performance, and challenges in the retail landscape, investing in Foot Locker carries considerable risk. With negative earnings trends, an unattractive valuation, and competitive pressures, FL is likely to face continued challenges in the foreseeable future. While some investors may anticipate a turnaround, the current fundamentals suggest caution when recommending the stock.

Top Stock Picks from Zacks Research

Among thousands of stocks, five Zacks experts have handpicked their favorites expected to soar by +100% or more in the upcoming months. From these recommendations, Director of Research Sheraz Mian has selected one stock with tremendous growth potential.

This company targets millennial and Gen Z consumers, attaining nearly $1 billion in revenue last quarter. The recent pullback in its stock price makes this an opportune moment for investment. Not all of our recommended stocks will succeed, but this one has the potential to outperform previous Zacks favorites, like Nano-X Imaging, which gained +129.6% in just nine months.

Discover Our Top Stock and 4 Contenders

For the latest recommendations from Zacks Investment Research, you can access the report detailing the 7 Best Stocks for the Next 30 Days. Click to obtain this free resource.

Foot Locker, Inc. (FL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.