“`html

Goodyear Tire Company Faces Significant Financial Pressures

The Goodyear Tire & Rubber Company (GT) anticipates an annual cost increase of around $350 million due to tariffs affecting consumer tires and raw materials, primarily as a result of the Trump administration’s trade policies. In Q4, raw material costs are expected to rise by $180 million, with an additional $50 million expected in Q3.

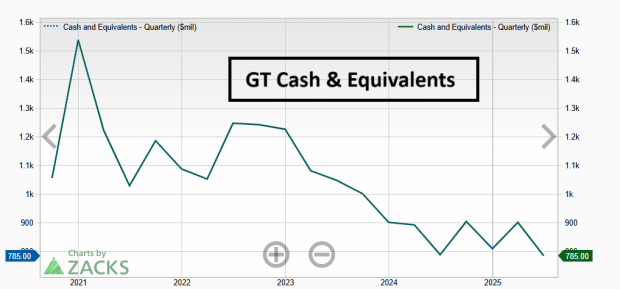

Goodyear is also experiencing declining sales volumes, projecting a decrease in tire sales globally this year due to sufficient inventory levels among U.S. wholesalers and stagnant demand in the Asia-Pacific region. The company plans to spend approximately $900 million on capital expenditures by 2025 to support technological upgrades amid challenges such as producing fewer tires and incurring more fixed costs.

Over the past five years, Goodyear shares have underperformed, decreasing by 10%, in contrast to the S&P 500 Index, which has nearly doubled during the same period.

“`