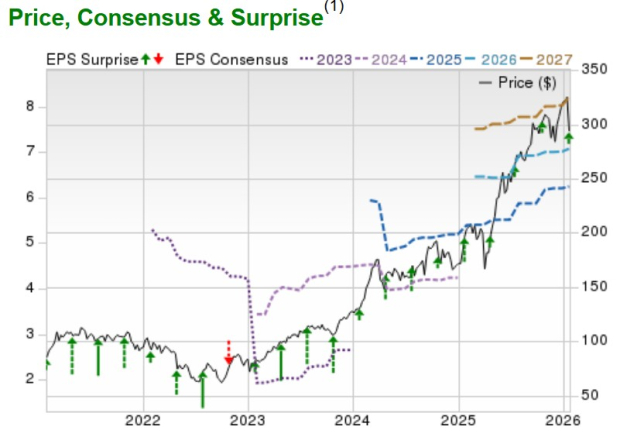

Grupo Aeroportuario Del Pacífico (PAC) is scheduled to report its Q4 2025 earnings results on February 23, 2025. The company has a concerning trend of underperforming against Wall Street expectations, having missed earnings forecasts for seven consecutive quarters, averaging a -6% surprise in its last four reports.

Despite PAC’s shares rising nearly 50% over the past year and currently trading at over $270, analysts’ sentiment is dim. PAC holds a Zacks Rank of #5 (Strong Sell) as EPS revisions have declined by over 2% in the last 60 days, indicating potential headwinds ahead. The forecast for FY25 shows a proposed EPS increase of 7%, but FY26 revenue growth is projected to slow to just 4%.

Investors may face selling pressure if the trend of disappointing earnings continues, despite PAC’s forward earnings multiple being reasonably priced at 21X.