J.Jill, Inc. (JILL) has seen its shares fall over 40% in 2025 due to a deteriorating earnings outlook, leading the company to withdraw its guidance for fiscal 2025, citing “macroeconomic uncertainty.” The women’s apparel retailer reported a 5% decline in revenue for both its fourth quarter fiscal 2024 and Q1 FY25.

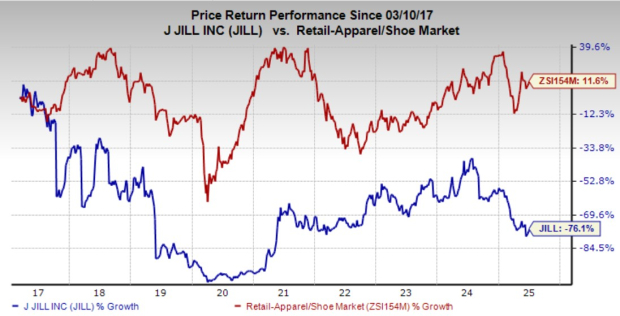

Operating over 200 stores in the U.S. and focusing on e-commerce, J.Jill has struggled since its 2017 IPO, with its stock down over 70% compared to a 170% increase in the S&P 500. The company’s adjusted earnings are projected to drop by 20% in FY25 alongside a 2% decrease in sales, further compounded by recent leadership changes and economic challenges.