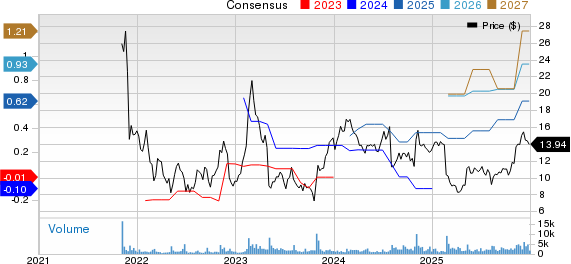

Founded in 2009 and headquartered in San Francisco, NerdWallet helps consumers make informed financial decisions through its comparison platform. The company operates in the U.S., U.K., Australia, and Canada, focusing on sectors like credit cards, loans, and banking. The company has a workforce of about 650 employees, generating substantial revenue through affiliate and lead generation fees. Analysts are optimistic about NerdWallet’s growth trajectory, raising estimates across future quarters, including a projected earnings increase from $0.47 to $0.62 for the current year.

Currently valued at $1 billion, NerdWallet is positioned for potential growth, with stock trading between $12.50 and $17. Analysts have also raised price targets, with Barclays increasing theirs from $14 to $17 and Morgan Stanley from $12 to $14. The company’s ongoing expansion in revenue and its established brand in the financial comparison space make it a notable investment opportunity as it approaches 2026.