Robinhood Markets Overview

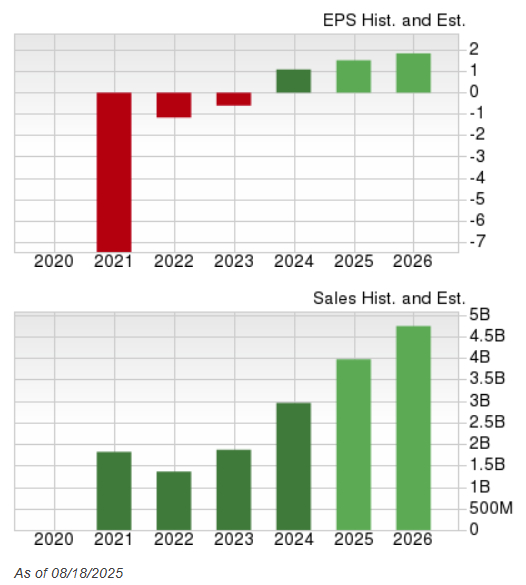

Robinhood Markets, Inc. (HOOD), founded in 2013 and headquartered in Menlo Park, California, has become a leading platform for retail investors by offering commission-free trading. The company experienced significant growth during the COVID-19 pandemic, boosting its user base as millennials engaged more with stocks. In 2024, Robinhood achieved profitability for the first time and recorded a compound annual growth rate (CAGR) of 36.7% in transaction-based revenue, with annual revenue doubling from 2022 to 2024.

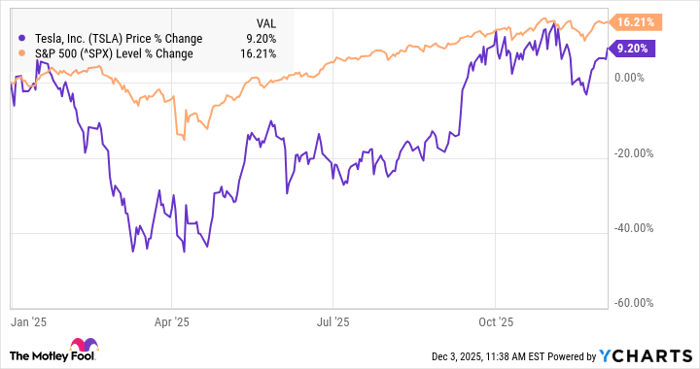

Market Performance and Growth Potential

Robinhood has beaten Wall Street estimates in nine of the past ten quarters, with a margin of 19.46% in the last four quarters. Analysts project continued robust performance, prompting upgrades in the company’s ratings. Additionally, new growth avenues include prediction markets, crypto trading, and the premium Robinhood Gold subscription service.

Future Outlook

Analysts expect Robinhood’s fundamental performance to sustain its upward momentum, reflecting confidence in the company’s strategy and diversification beyond equity markets.