“`html

Sea Limited: A Rising Star in Southeast Asia’s Tech Landscape

Sea Limited (SE) is transforming into a powerful technology conglomerate in Southeast Asia, operating in e-commerce with Shopee, digital financial services with SeaMoney, and gaming through Garena. This diversified model has made Sea Limited a key player in the region’s booming digital economy.

Since its peak in 2021, Sea Limited stock has faced significant volatility, plummeting over 90% until early 2024. This dramatic drop has led to a more balanced valuation that may foster recovery, which has been particularly evident over the past year as SE shares have gained momentum due to strong earnings revisions and ongoing revenue growth.

With a top Zacks Rank, investors might view Sea Limited as an appealing opportunity.

Image Source: Zacks Investment Research

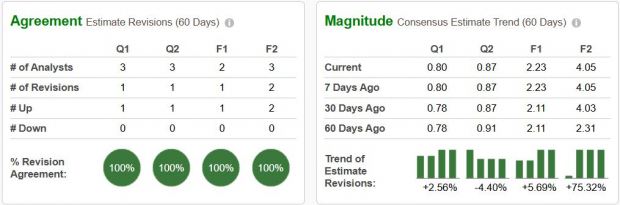

Strong Earnings Revisions Boost Sea Limited Stock

Sea Limited has seen a significant trend in earnings revisions, showcasing improvements in both fundamentals and investor confidence. In recent months, analysts have increased their earnings estimates significantly, awarding the company a Zacks Rank #1 (Strong Buy) rating. Projections for next year’s earnings have surged by 75.3% within just 60 days.

All three segments are performing well. The most recent earnings report indicated that e-commerce orders grew 24.3% year-over-year, while financial services revenue increased by 38% YoY and gaming revenue rose 24.3%.

Sales growth for SE is projected to be 30.3% this year and 18.9% for next year, reflecting continued growth in both its e-commerce and fintech services. The combination of earnings revisions and sales momentum is often a positive sign and may lead to sustained stock price increases.

Image Source: Zacks Investment Research

Sea Limited’s Shares: A Reasonable Valuation

Even with rapid revenue growth and increasing profitability, SE shares are still reasonably valued. Currently, the stock trades at a one-year forward earnings multiple of 30.1x, notably lower than its average valuation of 57.1x since its IPO.

Considering the company is projected to experience 81.5% earnings growth over the next year, this valuation seems quite justifiable. Investors seeking a high-growth prospect with appealing risk-reward metrics may find SE’s current price attractive.

Should Investors Consider Buying SE Shares?

Sea Limited stands out as a significant player in the global digital economy, enhancing growth through its diverse revenue streams. Given its strong earnings revisions, favorable valuation, and solid sales growth, SE appears to be on a promising path. While inherent short-term volatility must be acknowledged, the long-term outlook remains optimistic. For growth-focused investors, Sea Limited could represent a noteworthy investment opportunity in the current market landscape.

Research Chief Names “Single Best Pick to Double”

Among numerous stocks, five Zacks experts have each picked a favorite predicted to rise +100% or more in the coming months. From these five, Director of Research Sheraz Mian has identified one that he believes has the most potential for remarkable growth.

This company focuses on millennial and Gen Z markets, generating nearly $1 billion in revenue last quarter alone. A recent dip makes now a prime opportunity to invest. While not every elite pick leads to success, this one has the potential to outperform previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sea Limited Sponsored ADR (SE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`