Container Store’s Stock Takes a Nosedive Amid Dismal Earnings Forecast

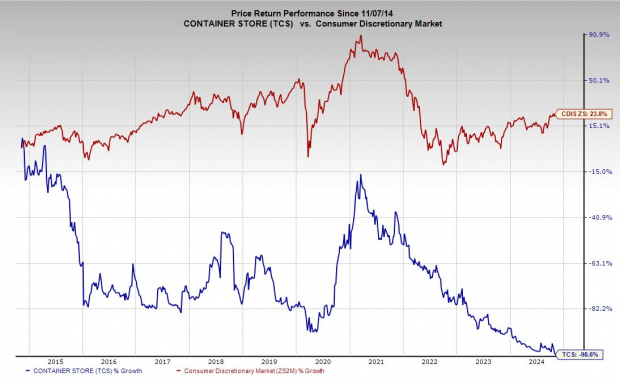

The Container Store Group, Inc. TCS stock has plummeted over 85% in 2024 alongside its tumbling earnings outlook.

This recent plunge is part of an overall decline that has plagued The Container Store over the past decade, interrupted only occasionally by brief recoveries.

A Closer Look at The Container Store Group

As its name implies, The Container Store Group specializes in retail containers. The company aims to provide organizing solutions, custom spaces, and in-home services with the mission to “transform lives through the power of organization.”

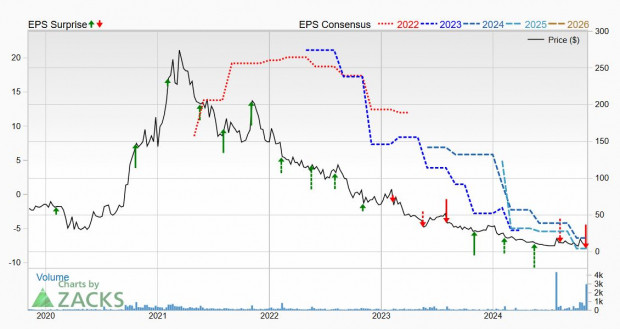

Following a strong boost during the COVID-19 pandemic, the company’s revenue has sharply declined in recent years. From fiscal years 2014 to 2022, the company saw steady growth, but analysts now project a -10% drop in FY24, followed by an additional -3% decrease in FY25.

Image Source: Zacks Investment Research

Financial Support and Strategic Reviews

In early October, The Container Store received a financial boost from Beyond, Inc., the parent company of Bed Bath & Beyond. On October 15, TCS announced an agreement to secure a $40 million investment through a preferred equity transaction.

This deal followed a significant announcement from the company in May, when it began a strategic review of its business operations and decided to halt financial guidance due to a challenging market environment.

Q2 Earnings Reveal Struggles

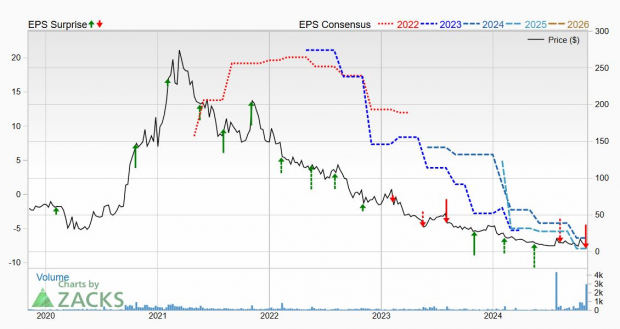

The company reported a substantial adjusted loss in Q2 FY24, posting -$3.23 per share, which was significantly lower than predictions had suggested. This unmet expectation has contributed to a decline in the company’s earnings outlook, earning it a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Outlook for Investors

The Bottom Line on The Container Store Group Stock

Analysts predict that The Container Store will experience an adjusted loss of -$6.36 per share in FY24, with further losses of -$7.90 anticipated in FY25. The drastic value decline of TCS stock over the past decade suggests caution for potential investors.

For now, it may be advisable for investors to steer clear of The Container Store Group stock until there are signs of a successful turnaround.

Expert Stock Recommendations

From a large pool of stocks, five Zacks experts have identified their top picks likely to double in value. Among them, the Director of Research, Sheraz Mian, has selected one with particularly strong potential.

This selected company caters to millennial and Gen Z audiences, producing nearly $1 billion in revenue last quarter. A recent pullback presents an ideal opportunity for investment. Although not all elite picks succeed, similar past recommendations like Nano-X Imaging saw impressive climbs, with a +129.6% gain in just over nine months.

To access detailed insights about our top stock and four others, you can download our free report titled “5 Stocks Set to Double.”

Container Store (The) (TCS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.