“`html

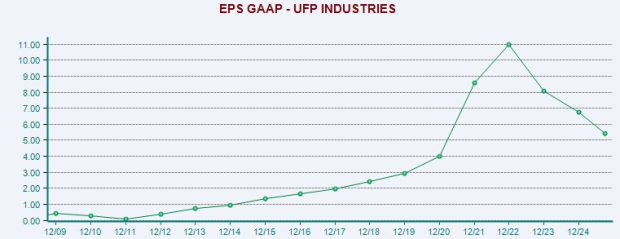

UFP Industries, Inc. (UFPI) has seen its stock price decrease by 30% over the past year due to a declining earnings outlook amid significant industry challenges. The Grand Rapids, Michigan-based company, a major player in the softwood lumber industry, reported a 25% decrease in revenue for 2023 and projects a further 4% drop in 2025. Its GAAP earnings fell by 27% in 2023 and are expected to decline by 16% in 2024.

UFP Industries has received a Zacks Rank of #5 (Strong Sell) following five consecutive missed earnings per share estimates, with the latest EPS estimate for FY26 being 10% lower than previously projected. The company operates across three main segments: Retail, Packaging, and Construction, primarily serving major customers in North America’s softwood market.

“`