Vera Bradley Struggles Amidst Declining Sales and Earnings Estimates

The apparel market remains challenging, marked by intense competition and shifting consumer tastes. In this environment, brands often face difficulties in maintaining their foothold.

Vera Bradley (VRA), a well-known name in handbags and accessories, is a notable example of this struggle. The company has seen a significant decline in sales growth over the past few years as more competent brands capture market share. Currently, this situation is evident in its Zacks Rank #5 (Strong Sell) due to falling earnings estimates.

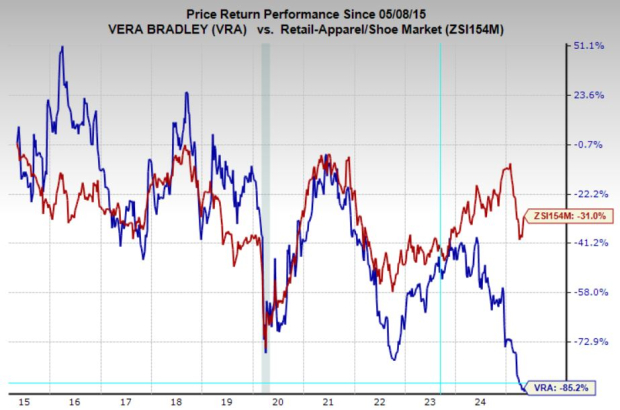

While the broader apparel sector has lagged over the last decade with a 31% decline, Vera Bradley’s performance has been even more concerning: its stock has plummeted 85.2% over the past 10 years and has decreased over 50% year-to-date. Without signs of a fundamental turnaround, VRA remains a stock to avoid.

Image Source: Zacks Investment Research

Sales Decline and Deteriorating Earnings Outlook

Vera Bradley’s fundamental outlook has worsened drastically, marked by significant declines in both revenue and earnings expectations. Sales fell 21% over the past year, reverting to levels not witnessed since 2011 and effectively negating over a decade of growth.

The future remains bleak, with projections indicating a further 24.6% decline in sales this fiscal year. This outlook reveals persisting challenges and weakening demand from consumers. Correspondingly, earnings estimates have been steadily declining, continuing a trend that began in 2021.

In just the past two months, estimates for next quarter’s earnings plunged by 95%, while next year’s forecasts dropped by 62%. This pattern of revisions has led Vera Bradley to a Zacks Rank #5 (Strong Sell), signaling serious warning signs for investors.

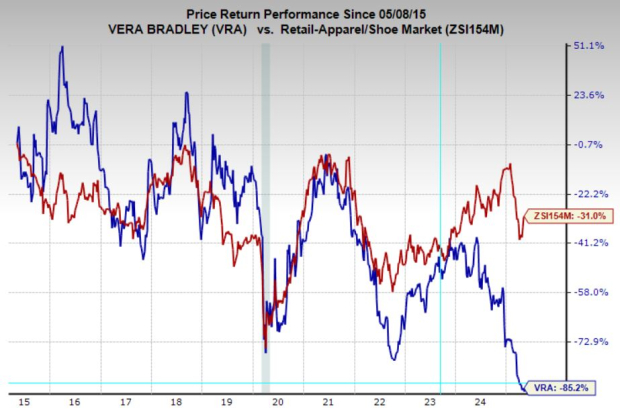

Image Source: Zacks Investment Research

Investment Perspective: Time to Avoid Vera Bradley?

With falling sales, shrinking earnings projections, and no evident turnaround catalysts, Vera Bradley is decidedly out of favor in the market. The company appears to be losing ground in an ever-evolving retail landscape, with the consistent decline in estimates suggesting that Wall Street anticipates continued struggles.

Investors should remain cautious and sidestep VRA until there is evidence of stabilization, whether through strategic changes, renewed consumer interest, or improved financial results. For now, weak fundamentals combined with a Zacks Rank #5 (Strong Sell) highlight this stock as one of the more concerning stories in the marketplace.