Westlake Corporation Faces Declining Demand Amid Economic Challenges

Westlake Corporation, established in 1986 and based in Houston, Texas, manufactures and markets a range of performance materials and housing products. Their offerings include ethylene, polyethylene, PVC, and landscaping products.

The company is currently challenged by heightened interest rates and inflation. These economic factors have diminished housing starts, negatively affecting demand and business confidence. Consequently, construction activities in North America have slowed, impacting Westlake’s pipe-and-fitting and siding-and-trim businesses.

Industry Ranking Impact

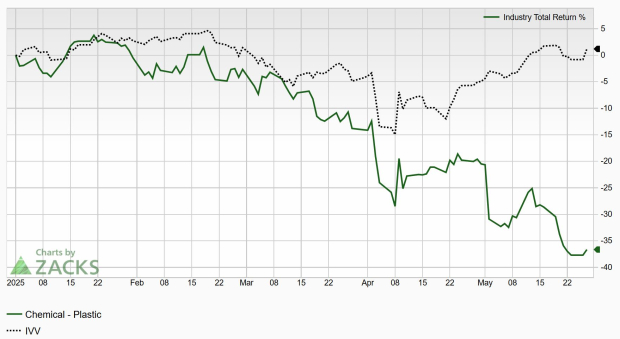

Westlake (WLK) holds a Zacks Rank of #5 (Strong Sell) and is part of the Zacks Chemical – Plastic industry group, which ranks in the bottom 1% of approximately 250 Zacks Ranked Industries. This suggests the industry is likely to underperform the market over the next 3 to 6 months, continuing the trend observed this year:

Image Source: Zacks Investment Research

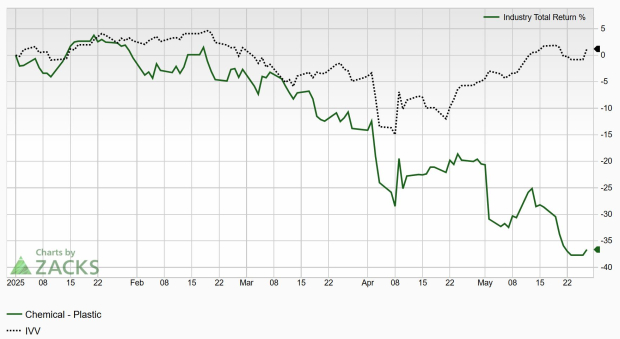

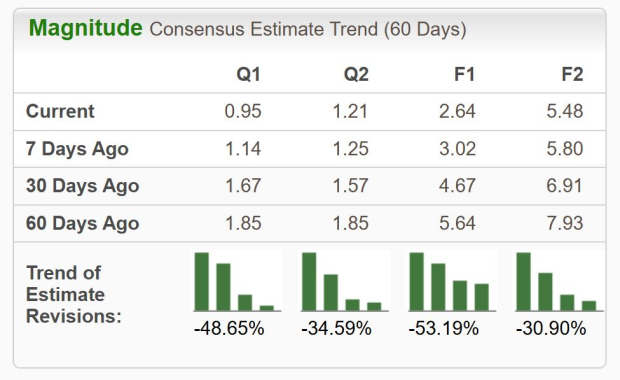

Stocks within this group are seen as overvalued and are expected to experience below-average earnings growth:

Image Source: Zacks Investment Research

Companies in declining industries often serve as potential short candidates. Although individual stocks can outperform, belonging to a weaker industry complicates recovery prospects.

Westlake’s shares have underperformed over the past year, continuing a trend of lower lows, and present a strong short opportunity as 2025 approaches.

Notable Earnings Misses & Outlook

Westlake has missed earnings estimates in three of its last four quarters. In May, the company reported a first-quarter loss of -$0.31 per share, missing the Zacks Consensus Estimate by -144.3%.

Over the trailing four quarters, Westlake has posted an average earnings miss of -61.4%. Regularly falling short of estimates typically leads to underperformance.

Recently, earnings estimates have been revised downward. Analysts cut estimates for the current quarter by -48.65% in the last 60 days. The Q2 Zacks Consensus EPS Estimate is now $0.95 per share, down -60.4% year-over-year.

Image Source: Zacks Investment Research

Declining earnings estimates raise significant concerns. Negative year-over-year growth is a trend that bearish investors favor.

Technical Indicators

WLK shares are in a prolonged downtrend, marked by a series of lower lows, substantially underperforming major indices. The stock is trading below its 50-day (blue line) and 200-day (red line) moving averages, a sign that supports bearish sentiment.

Image Source: StockCharts

Recently, WLK experienced a “death cross,” where the 50-day moving average fell below the 200-day moving average. A significant upward move and positive earnings revisions would be necessary to justify long positions. The stock has fallen over 35% this year alone.

Concluding Insights

With a weakening fundamental and technical outlook, WLK is unlikely to reach new highs soon. Its position in a poorly performing industry adds further challenges.

Frequent earnings misses and declining future estimates may cap any potential rallies, perpetuating the downtrend.

Investors might consider avoiding this stock or using it as part of a short strategy. Potential buyers should wait for signs of improvement before considering a position in WLK.