Westlake Corporation (WLK), a Houston-based manufacturer of performance and essential materials, is currently facing significant challenges driven by elevated interest rates and persistent inflation, leading to reduced housing starts and diminished demand for its products. The company reported a loss of -$0.31 per share in Q1 2023, falling short of estimates by -144.3% and experiencing an average earnings miss of -61.4% over the past four quarters. Analysts have cut second-quarter earnings estimates by -88.89%, forecasting just $0.06 per share, which signifies a staggering -97.5% decline year-over-year.

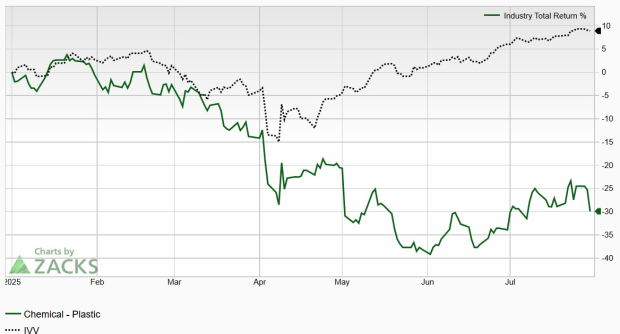

Westlake has seen its stock decline more than 30% this year, reflecting a significant downward trend alongside negative earnings estimate revisions. As a result, the stock has fallen to a Zacks Rank of #5 (Strong Sell), placing it among the bottom 4% of the Zacks Chemical – Plastic industry group. The technical outlook indicates a “death cross,” with its 50-day moving average dipping below the 200-day average, further complicating any potential recovery prospects.