“`html

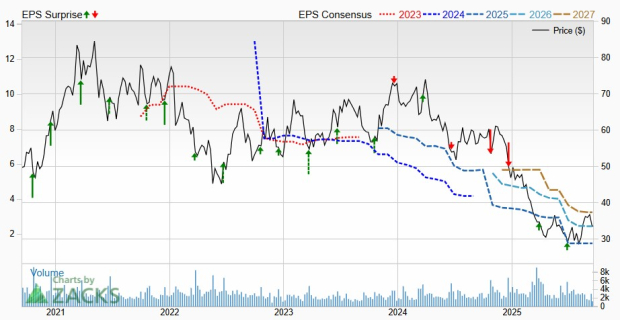

Winnebago Industries, Inc. (WGO) has seen its stock price plummet over 40% in the past year, contrasting sharply with a 20% increase in the S&P 500. The company’s earnings outlook has deteriorated significantly, leading to a Zacks Rank #5 (Strong Sell) due to multiple downward revisions.

Winnebago’s revenue skyrocketed from $1.98 billion in 2019 to $4.96 billion in FY22 but has since dropped, with expectancies of a further decline to $2.75 billion this fiscal year. Retail demand in the outdoor recreation sector remains “soft,” and adjusted earnings per share are projected to fall by 57% year-over-year in FY25, building on a 50% decline in FY24.

“`