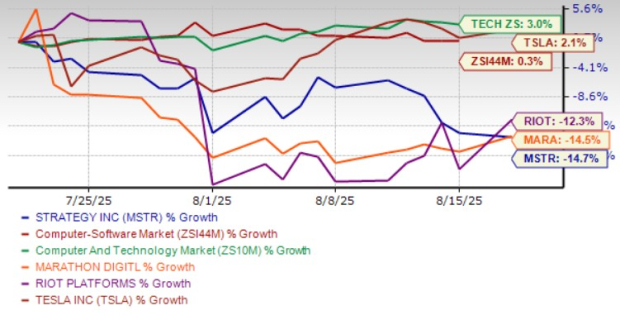

MicroStrategy Incorporated (MSTR) saw its shares decline by 14.7% over the past month, underperforming both the Zacks Computer – Software industry at 0.3% and the Zacks Computer and Technology sector at 3%. As of July 29, the company holds 628,791 bitcoins, representing approximately 3% of all bitcoins in existence, while competitors like Marathon Digital Holdings and Riot Platforms hold 49,951 and 19,273 bitcoins, respectively.

MicroStrategy is aiming for a bitcoin yield of 30% and potential gains of $20 billion if the bitcoin price reaches $150,000 by the year’s end. For 2025, the company projects operating income of $34 billion and net income of $24 billion, with earnings estimated at $80 per share. The company’s recent capital-raising efforts amount to $10.7 billion in equities and $7.6 billion in fixed-income securities year to date.

Despite these prospects, MicroStrategy’s current Zacks Rank is #4 (Sell), suggesting that its shares are overvalued with a Price/Book ratio of 2.15X compared to 1.24X for Marathon and 1.38X for Riot. Moreover, the third-quarter earnings estimate remains unchanged at a projected loss of 11 cents per share.