Ally Financial Faces Challenges Amid Rising Expenses and Deteriorating Credit Quality

Ally Financial: A Brief Look

Zacks Rank #5 (Strong Sell) stock Ally Financial (ALLY) operates in the online financial services sector, offering various banking and loan products. While the company primarily specializes in auto loans, it also provides banking services, mortgages, investment options, and insurance. Known for excellent service and innovative technology, Ally has established a significant presence in the financial landscape.

Rising Delinquencies Signal Trouble

A tough macroeconomic environment poses challenges for ALLY Financial. The company expects a substantial rise in delinquencies, predicting an increase of 7.4% in the near future. As consumer debt in the United States reaches record levels, averaging around $37,000, the pressure on borrowers is palpable.

Soaring Operating Costs

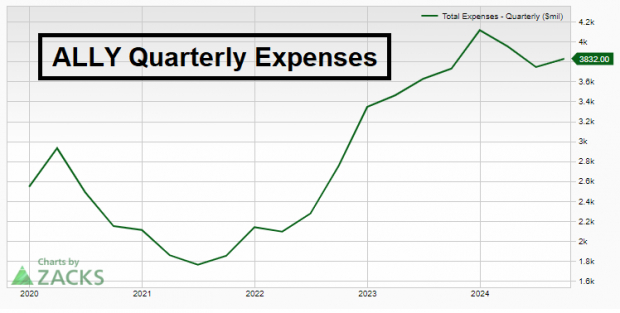

Increasing operating expenses are likely to curb Ally’s profit growth. Over the last five years, these costs have seen a compound annual growth rate (CAGR) of nearly 10%, primarily due to rising compensation and benefits.

Image Source: Zacks Investment Research

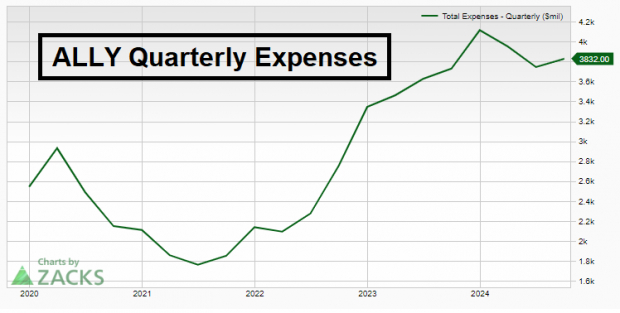

Recent estimates from analysts at Zacks indicate a downward revision for earnings in 2025, prompting investors to seek either a reduction in costs or at least stabilization.

Image Source: Zacks Investment Research

Given the company’s efforts to launch new products and expand its operations, it is projected that total non-interest expenses will grow at a CAGR of 2.4% through 2026.

Concerns Over Earnings Outlook

Zacks Earnings ESP (Expected Surprise Prediction) reflects recent analyst revisions. A negative ESP score indicates that ALLY has faced unfavorable analyst revisions recently. Typically, a negative ESP combined with a Zacks Rank #3 or worse (as is the case with ALLY) tends to lead to missed earnings expectations and underperformance compared to peers.

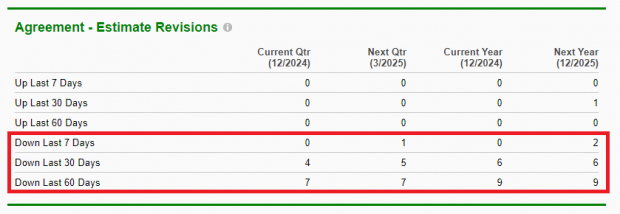

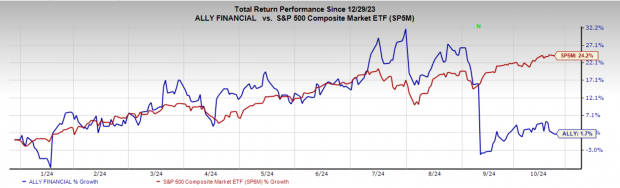

Performance Lagging Behind the Market

Compared to the S&P 500 Index, ALLY shares show relative weakness. As of this year, the S&P has risen by 24%, whereas ALLY shares have only increased by 1.7%. The stock is currently forming a classic bear flag chart pattern, indicating further concerns.

Image Source: Zacks Investment Research

Conclusion

The combination of rising expenses and challenging macroeconomic conditions makes Ally Financial a stock to be wary of.

Zacks’ Chief Researcher Identifies “Stock Most Likely to Double”

Our expert team has pinpointed 5 stocks most likely to increase by +100% or more in the upcoming months. Among these, the Director of Research, Sheraz Mian, highlights one stock with the highest potential for growth.

This top selection belongs to an innovative financial firm, boasting a rapid customer base expansion of over 50 million and a diverse range of advanced solutions. While not all picks succeed, this one shows promise, potentially exceeding past Zacks recommendations such as Nano-X Imaging, which surged by +129.6% in just over nine months.

Free: See Our Top Stock Along with 4 Runner-Ups.

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Ally Financial Inc. (ALLY): Free Stock Analysis Report

Read this article on Zacks.com here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.