Graphic Packaging Faces Earnings Challenges Amid Economic Headwinds

Graphic Packaging Holding Company GPK is a sustainable packaging firm that has recently fallen short of earnings expectations and provided disappointing future guidance.

This trend of declining earnings aligns with a broader economic slowdown coupled with persistent inflation. In early February, Graphic Packaging revised its earnings forecasts downward, demonstrating ongoing challenges in navigating today’s economic landscape.

Understanding GPK Stock

Graphic Packaging produces an array of essential paper packaging products, catering to clients in diverse sectors including food, beverages, personal care, and household goods.

Their offerings feature folding cartons, cooking solutions, and service containers among others.

Headquartered in Atlanta, Georgia, Graphic Packaging has partnered with numerous well-known brands and has strategically expanded its operations through significant acquisitions post-Covid.

Notably, its acquisition of AR Packaging Group in 2021 enhanced GPK’s geographical footprint, as AR was a prominent player in Europe.

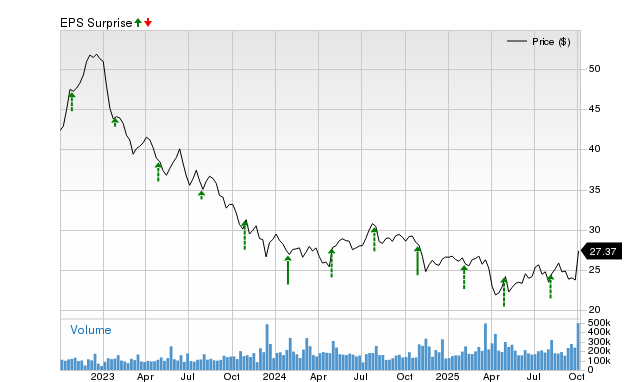

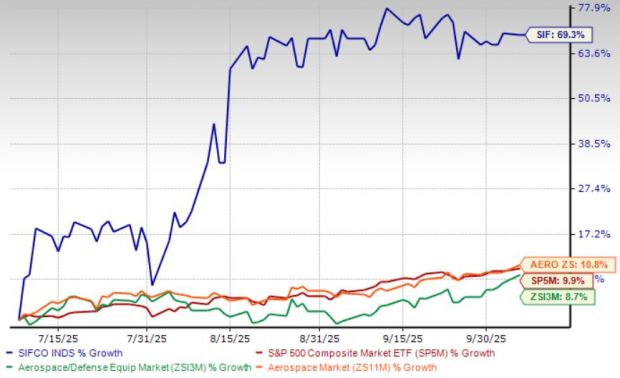

Image Source: Zacks Investment Research

In contrast, challenges in demand have been witnessed. GPK’s revenue dwindled by 7% in 2024 after seeing growth stall in 2023. Additionally, adjusted earnings dropped from $2.91 in 2023 to $2.49 per share for FY24.

Following its February 4 release, estimates for GPK’s 2025 earnings fell another 7%, and the FY26 estimate declined by 6%.

This downturn has placed GPK at a Zacks Rank of #5 (Strong Sell) and signifies a continuation of a negative trend initiated in 2023. CEO Michael Doss remarked in the Q4 commentary, “The past two years have presented unusual volume challenges for the industry and our customers.”

Doss added, “Customer destocking is largely over, but consumers are stretched and searching for value in their everyday purchases.”

Should Investors Avoid GPK Stock Now?

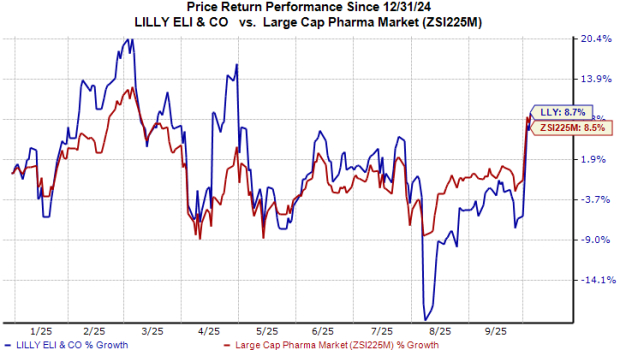

In the last two years, Graphic Packaging’s stock has appreciated by only 14%, contrasting sharply with the S&P 500’s impressive 52% increase. Over the past decade, while the S&P 500 has doubled in value, GPK has seen a 100% increase in its stock price in the last five years.

Despite maintaining a long-term optimistic outlook and increasing its quarterly dividend by 10%, effective Q1 2025, potential investors may want to exercise caution until the company revises its earnings guidance positively.

5 Stocks Expected to Double

Each of these stocks has been selected by a Zacks expert as a top pick with the potential to gain 100% or more in 2024. While not every selection may succeed, past recommendations have markedly outperformed expectations.

Many of the stocks mentioned in this report are currently under the radar, providing an opportunity for early investment.

Discover These 5 Potential Winners >>

Graphic Packaging Holding Company (GPK): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.