Market Turmoil: Tariffs, Recession Fears, and Bitcoin’s Decline

As I write on Monday afternoon, stock markets are in decline, particularly the Nasdaq, which has fallen over 4%.

The downturn stems from fears that President Trump’s tariff policies may trigger a recession.

According to The Wall Street Journal, President Trump mentioned over the weekend, that he couldn’t rule out a recession this year. During an interview with Fox News, he stated, “There will be a period of transition because what we’re doing is very big.”

Despite Commerce Secretary Howard Lutnick’s assertion that “There’s going to be no recession in America,” investor confidence remains shaky.

Tariffs Central to Trump’s Economic Strategy

For context, Trump highlighted his concerns last Friday. He stated, “Canada has been ripping us off for years on tariffs for lumber and for dairy products. 250% — nobody ever talks about that — 250% tariff — which is taking advantage of our farmers.”

He added that he might soon implement reciprocal tariffs on Canadian lumber and dairy imports, emphasizing, “They’ll be met with the exact same tariff unless they drop it, and that’s what reciprocal means.”

Trump conveyed that he might enact these tariffs within days, insisting “It’s not fair” for American producers.

Defining Fairness in Trade

Implementing tariffs on Canadian lumber and dairy products will increase the cost of these imports. U.S. producers could benefit by selling their goods at higher prices amidst reduced competition from cheaper Canadian products. While this may benefit U.S. manufacturers, U.S. consumers, who face higher prices, might not view this as fair.

Notably, U.S. consumers represent about 70% of the country’s GDP. Contrastingly, the U.S. dairy and lumber industries account for less than 4% of GDP, which raises questions about the fairness of prioritizing these sectors over consumer interests.

Economic Risks of Tariff Policies

Some analysts suggest that Trump uses tariffs primarily as leverage in negotiations to persuade other countries to reduce their duties on American exports. If this is the case, there is potential for a tactical use of tariffs, perhaps for a brief period.

However, as noted in Friday’s Digest, prolonged threats or uses of tariffs increase the risk of stagflation. Uncertainty regarding tariffs complicates corporate planning, resulting in delayed capital investments and hiring decisions, which could stifle economic growth.

Trump appears to disregard executive pleas for clarity from CEOs and investors. As reported by CNBC, he claimed, “They have plenty of clarity.”

On the inflation side of stagflation, consumers are expressing growing concerns about rising prices due to tariffs. The Federal Reserve Bank of Richmond reported last week that inflation expectations have risen for households, reaching 4.3%—the highest since November 2023.

This increased inflation expectation, along with a rise to 3.5% in longer-run expectations—marking the highest level in nearly 30 years—could lead to a cycle where consumers rush to buy before prices rise, further fueling inflation.

The Possible Consequences of Tariffs

There’s also the pressing question of what happens if Trump’s tariffs don’t yield the anticipated reductions in foreign tariffs but rather provoke retaliatory actions. This could escalate into a trade conflict, harming both economies.

Trump asserts that tariffs are already generating new manufacturing jobs, claiming, “We created almost 9,000 new jobs in the auto production field…so they’re already geared up.” However, if the cost of these jobs leads to higher auto prices for millions of Americans and potential recession, one must ask if that is indeed fair.

Ultimately, while a balanced trade deficit is desirable, it should not come at the cost of recession or a bear market.

Currently, the market is in decline as I write on Monday. Amidst investor hopes for a change in Trump’s policies, the likelihood of that seems slim.

Trump has commented on stock markets, stating, “What I have to do is build a strong country. You can’t really watch the stock market.”… He emphasized the long-term perspective taken by China, contrasting it with the quarterly focus in the U.S.

Despite the turmoil, the chances for a market rebound are increasing. We will delve deeper into this topic in tomorrow’s Digest.

In the meantime, adhere to your investment strategy. Ensure you follow your stop-losses while also keeping an eye out for valuable buying opportunities amidst market panic.

Challenges in the Crypto Market

On Friday, President Trump signed an executive order aimed at establishing a Strategic Bitcoin Reserve. This reserve will be funded by Bitcoin recovered from criminal and civil forfeiture cases.

The executive order will also create a U.S. Digital Asset Stockpile for seized cryptocurrencies, including ether, XRP, Solana’s SOL token, and Cardano’s ADA token, as posted on Truth Social.

Despite these developments, the market remains subdued. Many crypto enthusiasts were hoping for a more definitive endorsement from the government.

TD Cowen’s Jaret Seiberg noted, “We view this as a compromise.” He explained that the government is not using taxpayer money to acquire new digital assets but merely not selling seized assets.

Questions linger over the government’s commitment to acquiring Bitcoin, which may not fully satisfy market expectations, thus affecting investor sentiment.

U.S. Bitcoin Purchase Debate Leaves Market Expressing Uncertainty

The U.S. government may not acquire additional Bitcoin despite President Trump’s directions, as the process of justifying budget neutrality may prove politically challenging. A White House factsheet indicates that any potential Bitcoin purchases must avoid imposing extra costs on American taxpayers.

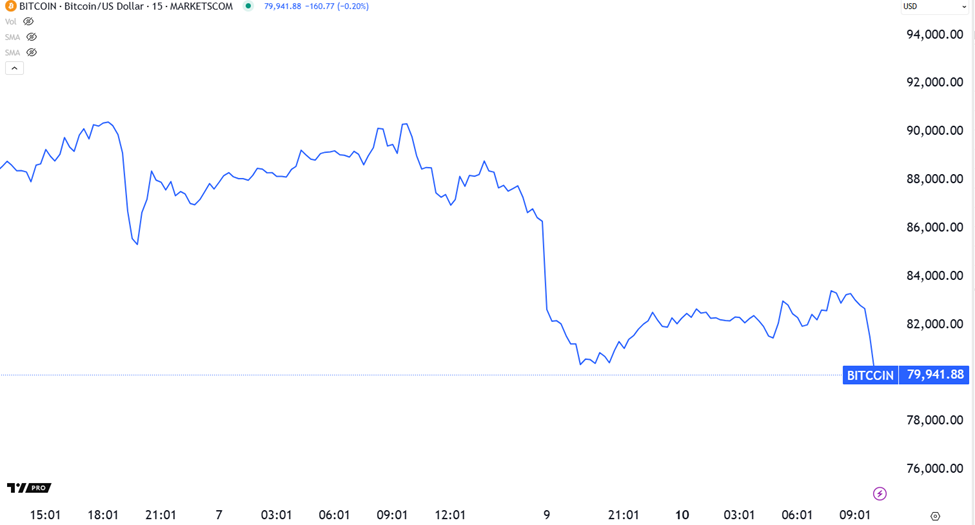

As markets process this news, they are adjusting to the reality that the government will not engage in significant Bitcoin buying, which reduces short-term bullish incentives for the cryptocurrency. Currently, Bitcoin is struggling to maintain support near $80,000.

Source: TradingView

Technical Analysis Reveals Critical Price Levels

From a technical perspective, Bitcoin is nearing a critical support level. Last week, it dipped below $85,000, prompting insights from financial analyst Luke Lango to his Crypto Trader subscribers. He noted that Bitcoin is caught between two significant moving averages:

- It remains above its 50-week moving average—once considered the ultimate line of defense during notable upticks.

- However, it has fallen below its 25-week moving average—a potential indicator of a forthcoming downturn.

If Bitcoin reclaims the $85,000 mark, there is potential for a vigorous bull market resurgence. Conversely, a drop below $75,000 could signal the beginning of a protracted crypto winter.

Currently, Bitcoin has temporarily recaptured the $85,000 threshold but is now at risk of slipping below the $80,000 level. Lango suggests adopting a cautious approach for the time being: “Now is not the time to sell or buy. Let’s observe how the market unfolds next.”

Amazon and Microsoft Clash in Quantum Computing

In a separate development in the tech sector, competition between leading companies in quantum computing has intensified. Microsoft recently announced a breakthrough in quantum technology, but Amazon’s quantum team has publicly challenged Microsoft’s claims. According to reports, Amazon’s head of quantum technologies, Simone Severini, stated that Microsoft’s assertions lack substantial evidence and have been marred by instances of scientific misconduct.

This competitive atmosphere is underscored by both companies’ ambitions in quantum computing. Amazon introduced its own quantum chip, called the Ocelot, which utilizes innovative “cat qubits” to store quantum information in a unique and still-experimental manner, referencing Schrödinger’s famous thought experiment.

While these advancements might sound complex, the implications for investment in quantum technology are significant. Louis Navellier, a noted investor, will be hosting a briefing on the potent opportunities emerging from developments in quantum computing, especially their potential implications for established firms like Nvidia.

Navellier emphasizes the critical importance of staying informed in this rapidly evolving space. He plans to unveil details about a promising small-cap stock that is closely associated with NVIDIA’s advancements in quantum technology, capitalizing on shifts in this new frontier.

As these narratives unfold, we will continue to provide updates on these topics in the Digest.

Best Regards,

Jeff Remsburg