The S&P 500 Index is up +0.44%, the Dow Jones up +0.36%, and the Nasdaq 100 up +0.52% following the US Consumer Price Index (CPI) report released today. The July headline CPI increased by +2.7% year-on-year, slightly below expectations, while core CPI was +3.1%, slightly above expectations. Post-report, the probability of a Federal Reserve rate cut at the September 16-17 meeting rose to 93% from 88% earlier this week.

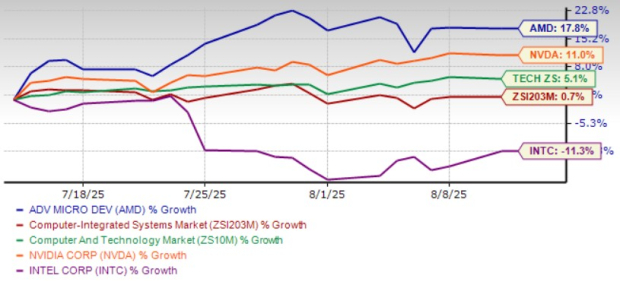

President Trump signed an executive order extending the US-China tariff truce for an additional 90 days until November 10 to facilitate negotiations. The order followed Nvidia and AMD’s agreement to pay 15% of specific AI chip sales to China to secure export licenses. Upcoming economic indicators include a forecasted drop in initial unemployment claims to 225,000 and a projected increase in July retail sales by +0.5% month-on-month.

In corporate news, Hanesbrands saw a +30% surge after reports of a potential acquisition by Gildan Activewear, while Cardinal Health’s stock dropped -9% following weaker-than-expected Q4 earnings. Market focus is on ongoing earnings results, with expectations for S&P 500 profits to rise +9.1% year-on-year.