“`html

The S&P 500 Index ($SPX) is down -0.26% as of today, while the Dow Jones Industrials Index ($DOWI) is up +0.09%, and the Nasdaq 100 Index ($IUXX) is down -0.59%. September E-mini S&P futures are down -0.16%, and September E-mini Nasdaq futures are down -0.48%. Key economic indicators released today include the unchanged June Philadelphia Fed business outlook survey at -4.0, and a -0.1% decline in the May index of leading economic indicators, marking the sixth consecutive month of decline.

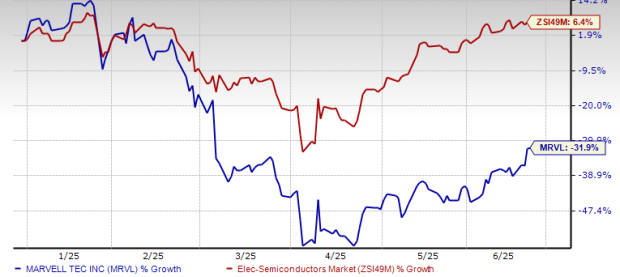

The U.S. stock market turned lower following a Wall Street Journal report indicating potential revocation of waivers for allies with semiconductor plants in China, creating weakness in chip makers. Notably, Lam Research (LRCX), KLA Corp (KLAC), and Applied Materials (AMAT) are down more than -3%. Additionally, overall market performance is affected by tensions related to the Israel-Iran conflict, as hostilities enter the eighth day, and Iranian officials have stated they will not negotiate with the U.S. while military actions persist.

As of today, the market is speculating only a 15% chance of a -25 basis point rate cut by the Federal Open Market Committee (FOMC) during its July 29-30 meeting, influenced by dovish comments from Fed Governor Waller regarding potential interest rate reductions.

“`